- The EIA raises 2022 demand forecast by 20,000 bpd to +2.10mbpd y/y

- Cuts 2023 demand growth by 90k bpd to 1.97 mbpd y/y

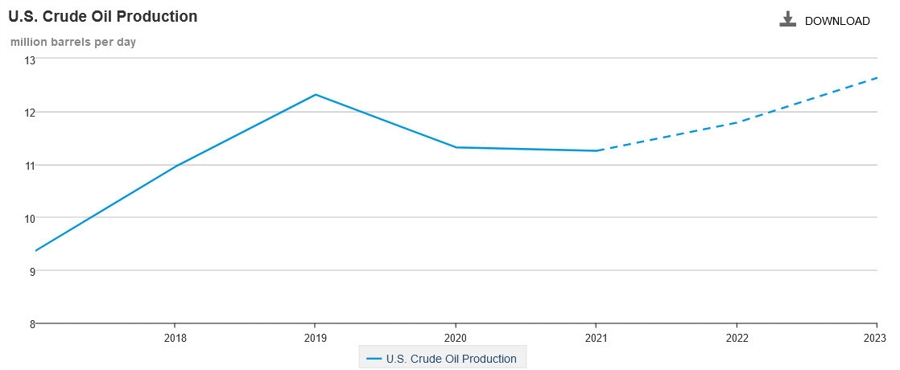

- Sees 2022 US output of 11.79 mbpd up 540kbpd this year vs +610k prior

- Output to rise 840k bpd in 2023 to 12.63mbpd

- 2023 US demand to rise 350k vs 410k last month

The big question is: How much will US production grow? I’ll take the ‘under’ on what they’re projecting, especially with prices falling again today. It’s the time of year when oil companies begin discussions on 2023 budgets and with prices here, the first call on capital won’t be new drilling. Moreover, the inventory of DUCs is essentially exhausted and there are widespread reports of drill pipe shortages, rigs and workers.

Put another way, here are the numbers from Giovanni Staunovo:

That’s to 12.32m from 11.71 in the period from July to December. Or increasing 610,000 barrels per day in five months. Or as he replied to me:

11.71 july

11.86 aug

11.86 sep

11.94 oct

12.22 nov

12.32 dec

That’s aggressive.

In any case, WTI crude oil is near the lows of the day, down $4.10 to $82.76.