Markets:

- NZD leads, GBP lags

- S&P 500 down 42 points to 3924. Down 3.3% for the week

- Gold up $14 to $1709

- US 10-year yields down 7 bps to 3.19%

- WTI crude down 43 cents to $87.04

The day was cut in half for US traders with two completely different themes. Early on, the jobs report hit a goldilocks note. The headline was a touch higher than expected but unemployment rose and earnings were slightly below the consensus. That was enough to spark a drop in the US dollar, giving back much of yesterday’s gains on most fronts. It also kicked off a risk rebound in stocks as front-end yields plunged.

At midday, it was turned on its head as Russia shut down the Nord Stream 1 pipeline completely, announcing that it won’t resume at 20% flows as expected. There was the pretext of an oil leak in the turbine but no one is believing that and even with storage levels high, Europe will now be in a dire position to get through winter without harsh rationing and the economic consequences that go with it.

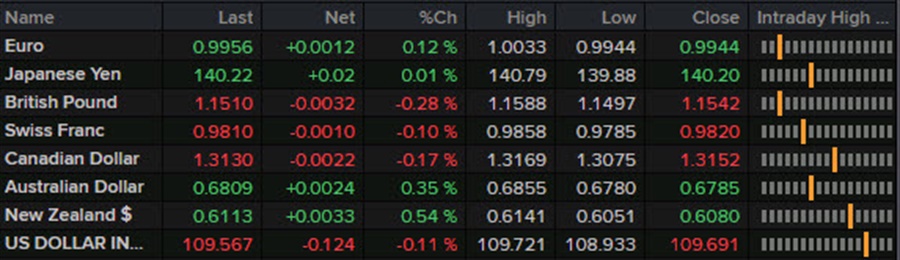

The euro immediately fell to 0.9950 from 1.0025 and cable plunged back to 1.1500 from 1.1580. Both held yesterday’s lows but not with much of a cushion.

The commodity currencies had been having strong days but gave back a big chunk of gains. They still managed to finish higher with NZD leading the way with a 33 pip gain to 0.6113.

USD/JPY was choppy after non-farm payrolls as it fell initially back below 140.00 and then hit a new 24-year high at 140.79 not long afterwards before slipping back to 140.22. There was some jawboning in Japanese hours and that will be a factor to watch.

Monday is a holiday in the US and Canada but I’m not sure that will mean a quiet market. We’ll also get the UK PM vote on Monday.