The USDCHF has seen sellers enter as London/European traders look to exit for the day and put the end to the month of August. The declines coms after a move up of about 230 pips from the low from Friday. The pair is trading back towar the close from yesterday at 0.9743. The current price is trading at 0.9745 after reaching a NY/London session low of 0.9733 in the current hourly bar.

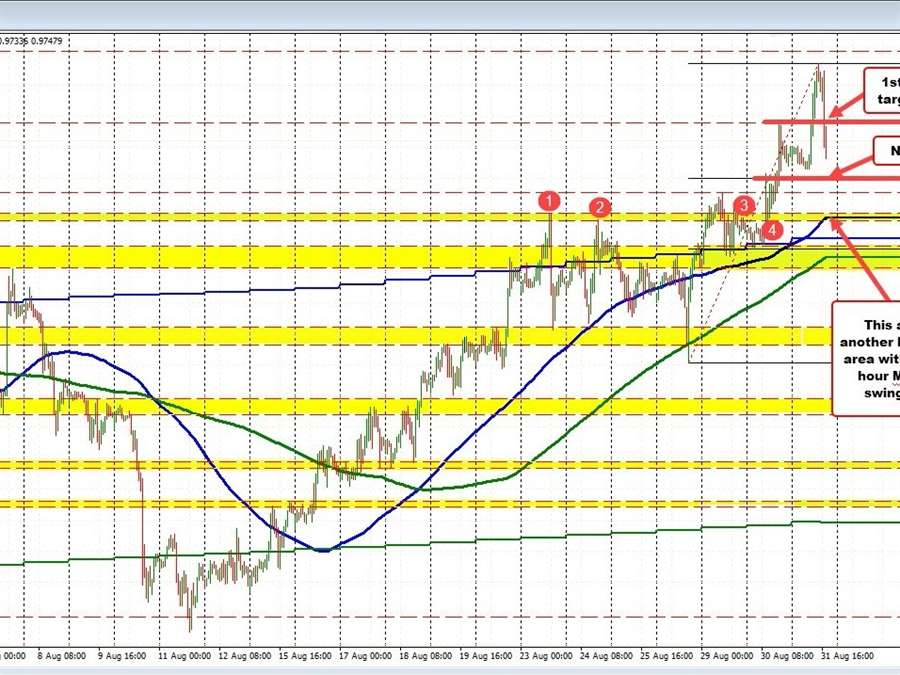

Looking at the hourly chart above, the move to the downside has been able to break below the 0.97614 high from yesterday’s trading. That was the closest target to get to and through if the sellers were to tilt the bias more to the downside.

The 38.2% of the move up from the Friday low at 0.97189 is the next target (see video from this morning – you can fast forward to 5:50 on the video to hear my thoughts).

Getting below that target is the minimum retracement target if the sellers are to take more control. Below that and the rising 100 hour MA is near the 50% and also a swing area in the 0.9686 to 0.96918 area.

So sellers have entered. Taken some profit and got some short term satisfaction below 0.97614. That is the a close risk level for sellers looking for more of a correction. Having said that, the sellers still need work to do.