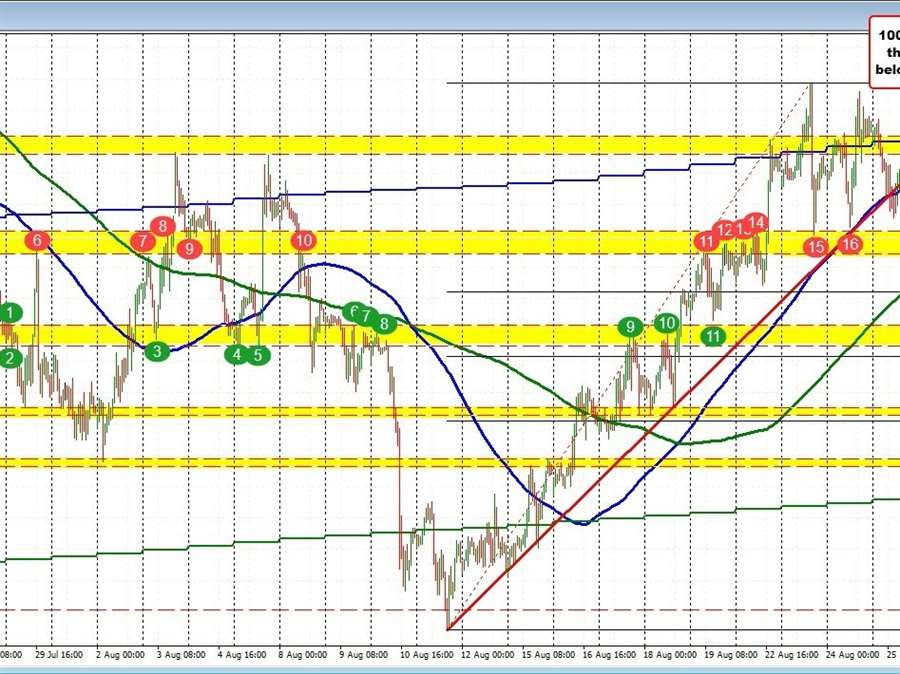

The USDCHF is moving to a new session low and at the lowest level since Monday. The 200 hour moving average is being approach at 0.95907. That moving average is near a low swing area between 0.9591 and 0.96046 (see renumbered circles). A move below that level would have traders targeting the 38.2% retracement of the move up from the August low (at 0.95689). Below that is a another swing area between 0.9537 and 0.9549 (green numbered circles).

Sellers are trying to take more control. They started the process by holding below the 100 day moving average above and 0.9660 at the highest for the day. The fall back below the 100 hour moving average of 0.96420 was also a more bearish tilt – with work to do.

That more work involves getting below the 200 hour moving average today. Time will tell but the sellers are taking more control help by the weaker than expected core PCE, and less fear from what chair Powell might have to say.