It’s a rout everywhere in markets today but oil managed to hold up, gaining 58-cents to $93.06. That’s despite the risks of an Iran deal announcement on the weekend (admittedly, those might be two-way risks).

In any case, I want to write about what’s unfolding in diesel right now.

I believe that’s the metric to watch for natural gas-to-oil switching. If you’re driving by your local pump, make a mental note of the diesel price and the spread to gasoline. That’s widening and it could blow out.

That’s because diesel is the preferred fuel for natural gas switching and there will be an increasing call on it.

What will make that challenging is two things:

1) Russia is a major refinery and controls refineries in Germany as well. Once Europe cuts off Russian products, it will become even tougher for them to get diesel.

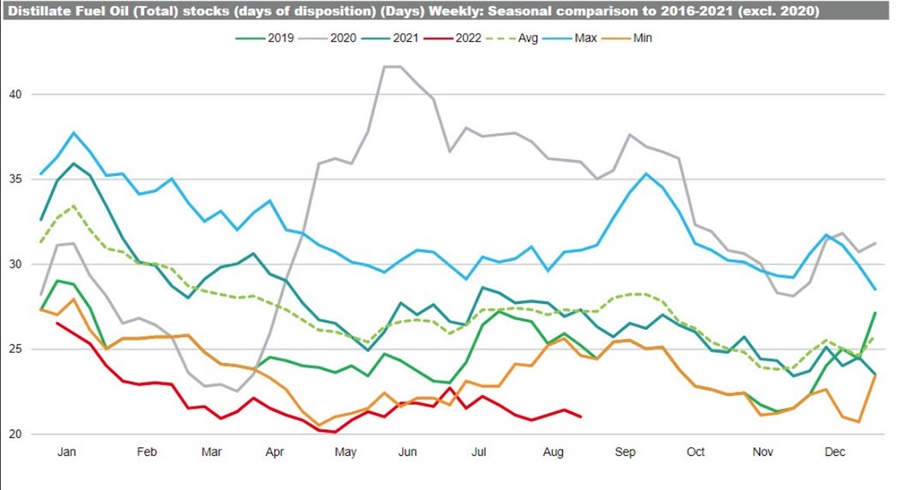

2) The WSJ reported this week that Energy Secretary Jennifer Granholm sent last week in a letter imploring seven major refiners to limit fuel exports. The letter wasn’t released publicly but warns that diesel stocks are nearly 50% below the five-year average in the northeast.

“It is our hope that companies will proactively address this need,” she adds. “If that is not the case, the Administration will need to consider additional Federal requirements or other emergency measures.”

It’s rich that the adminstration is telling private companies not to draw down on emergency inventories while they run down the SPR in order to hang onto a few House and Senate seats.