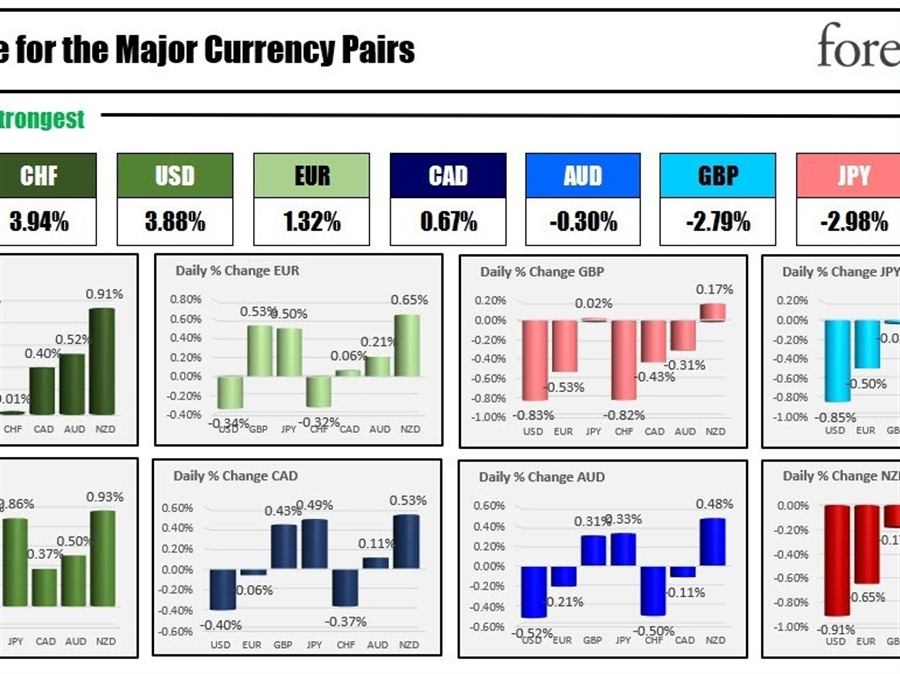

As the North America session begins, the CHF and USD are running neck and neck with each other for the strongest of the major currencies. The CHF is the weakest (with the JPY following behind). There are lots of different stories driving the summer trading today. Energy and growth remains a concern. Although the Rhine is expected to benefit next week from rain this week (levels stalled the transport ships with call and energy to powerstations halted), China is having the same problem from draught conditions as the river Yangtze dips to half its normal level. China has also provided support to their fledgling real estate market. UK consumer confidence (Gfk consumer confidence) fell to a new low.

US stocks are lower as the meme stocks tumble after word that Chewy founder Ryan Cohen dumped all of his stock and options after a “pump and dump”-like scheme this week sent shares of Bed, Bath and Beyond racing to the upside. Investors had hoped that Cohen would stay a major holder and guide a turnaround. Fed officials also started to chirp with more of a hawkish anit-inflation tone again (and the market is paying attention today). Next week is the Jackson Hole summit where the same rhetoric is expected highlighted by Chair’s Powell speech next Friday (at 10 AM ET – oh no we have to wait all week).

The news today has risk off flows in effect with the NZD, AUD and NZD all at the bottom of the table and the CHF and USD at the top.

In other markets:

- spot gold is trading down $7 or -0.40% at $1751.91.

- Spot silver is down -26 answer -1.34% in $19.25

- . WTI crude oil futures are trading down $1.20 at $88.92

- bitcoin has fallen sharply on risk off flows (trading with the meme stocks? It is trading at $21,444. The low price reached $21,273 while the high was up at $23 $202

In the premarket for US stocks, the major indices are lower after yesterdays mixed/marginal results.

- Dow industrial average is down -228 points after yesterdays 18.72 point rise

- S&P index is down 36 points after yesterdays 9.7 point rise

- NASDAQ index is down -136 points after yesterdays 27.22 point rise

The S&P and NASDAQ are on pace for a lower close this week which would be the 1st in a 4 weeks. The Dow is still on pace for a modest rise.

In the European equity markets, the major indices are mixed:

- German DAX, -0.52%

- France’s CAC, -0.38%

- UK’s FTSE 100 +0.24%

- Spain’s Ibex -0.67%

- Italy’s FTSE MIB -1.4%

In the US debt market, there is no flight to safety. Instead yields are higher as traders markup yields on a tighter Fed policy:

in the European debt market, yields are also sharply higher. The German to US 10 year spread has declined to 1.72% (was up near 1.9% last week). German PPI data was worse than expected which has traders thinking that a 50 basis point hike by the ECB might be more of a possibility at the next meeting.