BoA on G10 FX, a quick snippet view:

We expect the USD to remain strong for the rest of this year. The overheating US economy and the hawkish Fed have a lot to do with the strong USD.For the USD to weaken, the Fed has to be more concerned about growth than about inflation, and we are not there yet.

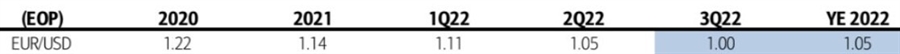

Meanwhile, the ECB mentioned the weak EUR as one of the reasons for its 50bp rate hike in July. but the vagueness and discretion of the Transmission Protection Instrument may invite markets to test it. We have kept our year-end EURUSD forecast at 1.05, but this remains subject to substantial risks, including around the energy backdrop and the extent of China’s slowdown.

We expect USDJPY to remain supported by the rising FX carry and Japan’s deep trade deficit amidst elevated energy prices.

We stay bearish on GBP including vs. the EUR.

We expect EURCHF to remain around parity this year on a hawkish SNB and the likely unfriendly risk backdrop in the near term. We remain constructive on the risk-sensitive 610 FX towards war-end, but we are cautious in the near term.

Forecasts: