Major currencies are seeing little change with the dollar mostly steady, as all eyes turn towards the US retail sales data later today.

Equities and bond yields are also observing light changes, so there isn’t much to work with as we get into European morning trade. After the wild swings yesterday, markets are more guarded and will await further clues in determining what the Fed will do later in the month. The debate now is between a 75 bps and a 100 bps rate hike.

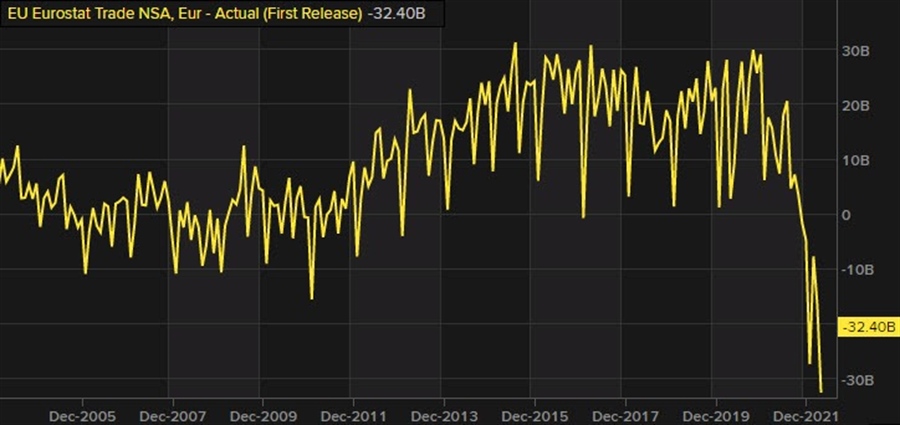

Looking ahead, Eurozone trade balance will be in focus in terms of key releases. The data itself may not stir much of a reaction but is in part one of the reasons why the euro has struggled considerably over the past few months. April saw a record trade deficit as imports surged due to high energy costs and one can expect that to stay the course with Germany having posted its first monthly trade deficit since 1991.

0900 GMT – Eurozone May trade balance data

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.