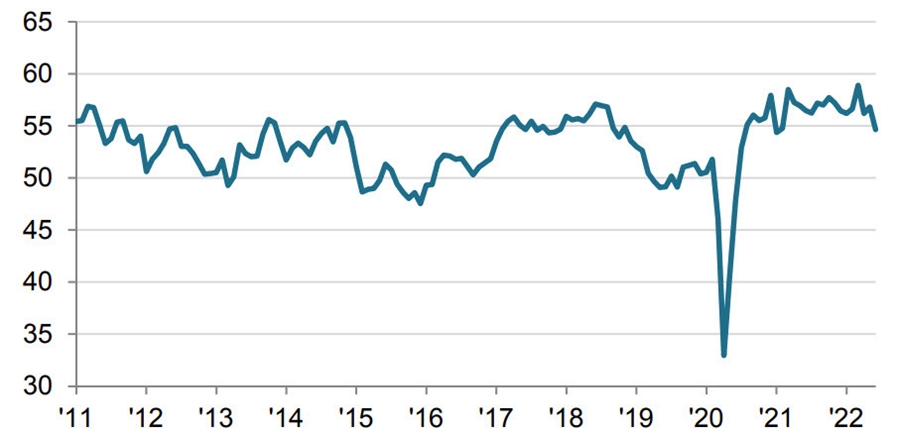

- Prior was 56.8

- Sentiment hit at 17-month low though still positive

- New orders at 23-month lows

- Production volumes grew in June for the 24th consecutive month

- Further acceleration in backlogs

- Input prices accelerated in June

- Full report (pdf)

Everyone expects a slowdown in factory activity after the pandemic boom, but where it settles out is tough to forecast. Seeing how weak auto sales were in June, there’s a growing risk of an evaporation in new orders.

Commenting on the latest survey results, Shreeya Patel, Economist at S&P Global Market Intelligence said:

“There were signs of difficulty in Canada’s manufacturing sector in June. The PMI dipped to the lowest for 17 months amid softer uplifts in output, new orders, purchases and employment. Global supply issues and steep price pressures were at the heart of the issue, and are expected to continue to disrupt the manufacturing economy this year.

“Canadian manufacturers particularly struggled with sourcing key materials. A notable slowdown in purchasing activity could hinder production significantly over the coming months. Sales was also hit hard, but more so from international markets at the end of the quarter.

A dip in confidence indicates firms are aware of the real difficulties that could hit the global economy in the next 12 months. Firms have recovered well from the pandemic and will now have to gear up for further hardship.”

/ CAD