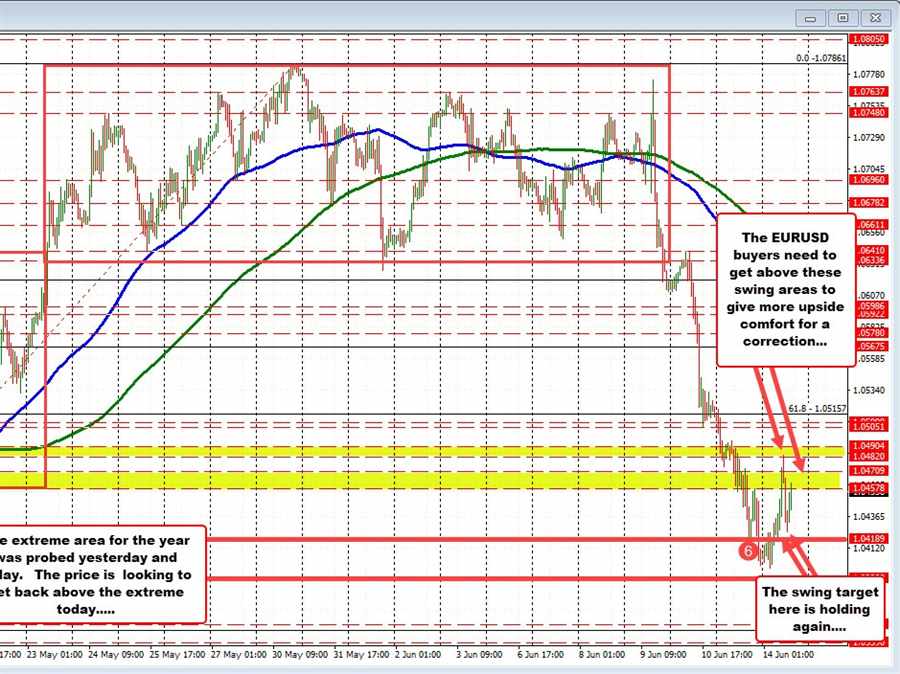

The EURUSD is trying to push higher after a run back into the 2022 lower extreme area between 1.04578 at 1.03485. The low price reached 1.0396 today which was short of the next swing area target at 1.0388. After breaking above another swing level target at 1.04189, buyers started to lean against that level and the level is providing a support base.

The move to the upside was able to extend back into the old “red box” with the low of that box at 1.04578 (see chart above). The 1st try above that area backed off after reaching into another swing area between 1.04821 and 1.04904. After dipping down toward the 1.04189 level and finding buyers, the price is currently back above the 1.04578 level trading at 1.0466.

There is an attempt being made to take back some control. The buyers would love to now see the price stay above 1.04578 and push above 1.0482 – 1.04904 swing area. If that can be done, the short-term bias would gather a little more traction after the sharp falls seen over the last 3 trading days.

Conversely, if the momentum to the upside starts to fade, traders who are hoping for more upside momentum, would not want to see a move back below the 1.04189 level.

The last 3 trading days has seen the price move from a high of 1.0773 down to the low today at 1.03963. That is a move above 377 pips in a relatively short period of time. The price entered into the lower extreme and could not get down to the lower targets including the low for the year at 1.03485. So there is some hope for a corrective move.

Having said that there is still a lot of work to do to take back more control by the dip buyers, and they certainly are not out of the proverbial woods just yet. They may see some late, but it’s still dark in there.