Earlier this week it was all about Treasuries.

The whims of the bond market were seemingly steering sentiment elsewhere. Today though US 10-year yields are up just 1.6 basis points in a back-and-forth trade but risk aversion is high and worsening.

The S&P 500 is down 67 points, breaking below the range of the past two weeks and slumping into the close.

That has weighed on AUD/USD as it falls below 0.7100 for the first time since May 26.

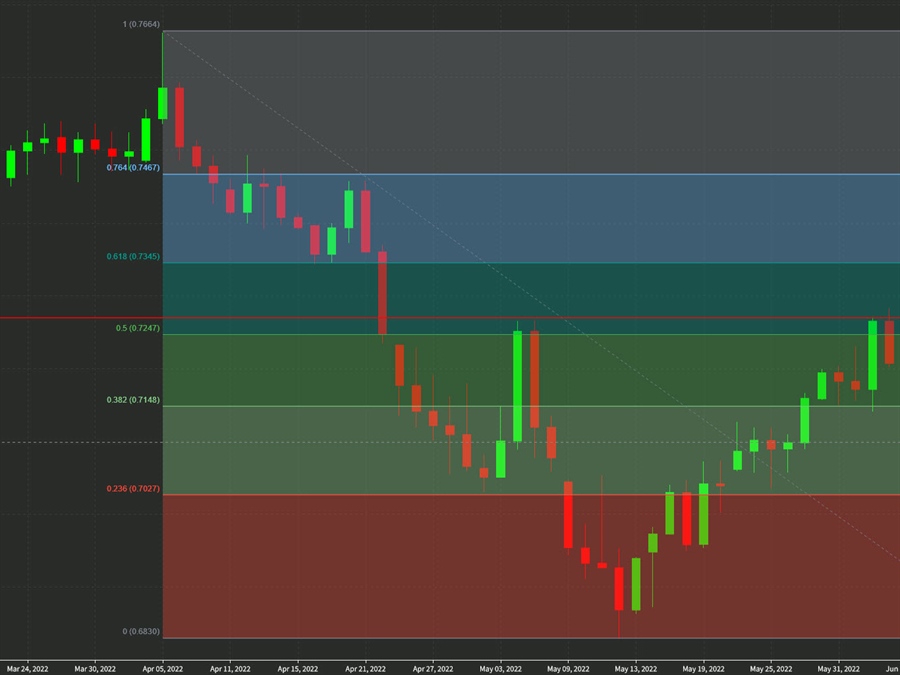

The chart is troubling as the pair stalled out at 0.7283 which is near:

- The 50% retracement of the March-May drop

- The early-May bounce, setting up a double top

Given what we’re seeing in stocks and given the growing fears about global growth, these aren’t technical signals to ignore.

This article was originally published by Forexlive.com. Read the original article here.