National Australia Bank were forecasting a +0.1% q/q result for January – March economic growth but yesterday revised that much higher:

- Q1 GDP is expected to rise 0.7% q/q and 3.0% y/y.

- That’s on the back of a continuation of the consumption rebound out of Q3 lockdown impacts. That ongoing services-led consumptions rebound is expected to be the main takeaway from the release, but the pre-GDP partials paint a complex picture.

- Pre-GDP partials last week on the investment side point to a capacity-constrained picture for business and dwelling investment, with weather disruptions a factor.

- Balance of payments data … suggests a surge in import volumes will result in 1.7ppt netted from GDP growth. But those imports had to end up somewhere, and a 3.2% surge in inventory levels suggests a strong 0.6ppt contribution to growth.

- Public demand on the back of still-elevated pandemic-related health spending will also support.

Earlier previews are here:

This

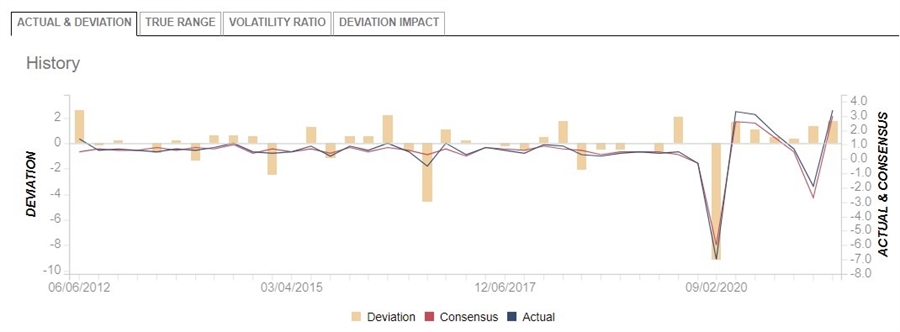

snapshot from the ForexLive economic data calendar,

access

it here

. To see this graph, click on this:

This article was originally published by Forexlive.com. Read the original article here.