Coming up at 1230 GMT from the US on Friday, 27 May 2022:

- April Core PCE price index, used as an indication to inflation

- This is a less volatile measure of the PCE price index, it strips out food and energy prices

- Published by the US Bureau of Economic Analysis

Goldman Sachs forecast is a little under the consensus (see pic of calendar below):

- +0.21% m.m, ” now corresponding to a year-over-year rate of +4.74%”

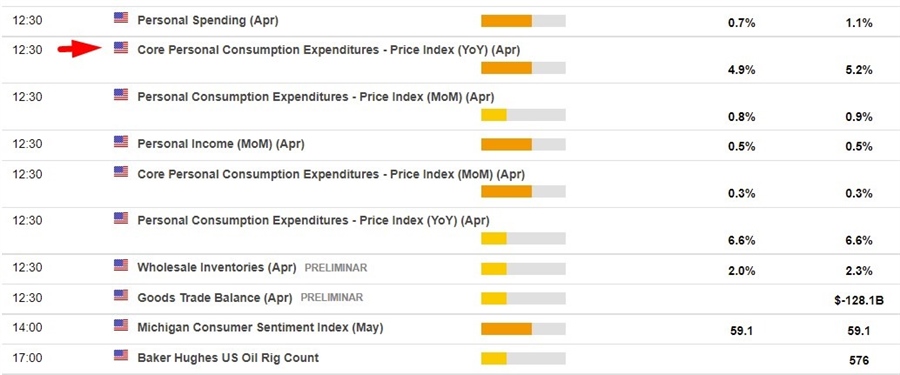

This snapshot from the ForexLive economic data calendar, access it here .

The times in the left-most column are GMT.

The numbers in the right-most column are the ‘prior’ (previous month) result.

The number in the column next to that, where is a number, is the consensus median expected.

Under 5% would be the first time in 2022: