The AUDUSD is trading up and down as traders await the next shove.

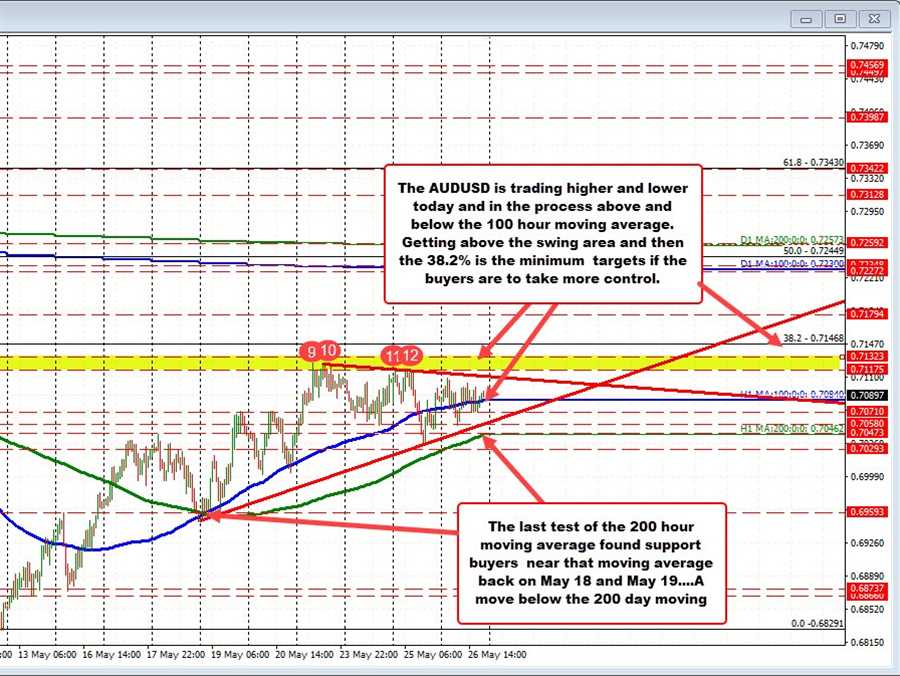

Looking at the hourly chart above, the consolidation has seen the price trade above and below the 100 hour MA (blue line) currently at 0.70909. The high price today reached 0.7109 in the Asian session, and a low 0.70563 in the early European session. The low to high trading range of 53 pips is about half of the 101 pip average over the last 22 trading days.

Traders are debating the next move and it is evident by the up and down price action.

For the week, the high price was reached on Monday. Those levels reached into a swing area between 0.7117 and 0.7132 (see red numbered circles in the chart above). Above that level, and the 38.2% retracement of the move down from the April 5 cycle high (which is also the 2022 high) at 0.76607 (not shown in the chart above) comes in at 0.71468.

Ultimately, if the buyers are to take more control, getting above the 38.2% retracement is the minimum retracement level to get to and through. Absent that, and the correction is just a plain-vanilla variety.

On the downside, a move back below the 100 hour moving average would target the 200 hour moving average currently at 0.7046. Last week, the corrective lows on May 18 and May 19 stalled near the 200 hour moving average. The moving average is now higher making it an easier hurdle to get below. It also would be a bullish development if the price can stay above that level especially on a corrective move to the downside.

Conversely a break below and all bets are off for further upside momentum. The sellers would be more in control.

Taking a broader look at the daily chart, the low price in May reached the high of a swing area going back to midyear 2020. The price bounced and moved above the old swing lows from 2021 and 2022 between 0.6966 and 0.7005 (see red numbered circles in the chart below). That area will be a key support area on any dip lower.

The 0.70862 to 0.71038 was a another swing area from 2021. The price has been trading above and below that level over the last week or so. Move above that level and the 38.2% retracement of the move down from the 2022 high comes in at 0.71463 level. Above that and traders will start to look toward the 100 day moving average and 200 day moving averages which are also near the 50% midpoint of the 2022 range near 0.72446.

Summary: Off the hourly chart, the price is above the 200 hour moving average but is consolidating above and below the 100 hour moving average. If the price is going higher, getting above the 38.2% retracement of the 2022 range at 0.71463 is a key hurdles to get to and through. On the downside, moving below the 200 hour moving average at 0.7047 would not be good for the buyers and would likely lead to more selling momentum. Traders would then target the 2021 and 2022 low levels.