The US stocks are trading higher and to new session highs for the major indices as European traders exit for the day.

- Dow industrial average is up 527 points or 1.66% at 32257

- S&P index is up 107 points or 2.72% at 4038

- NASDAQ index is up 482 points or 4.25% at 11853.29

- Russell 2000 is up 64 points or 3.7% at 1803.71

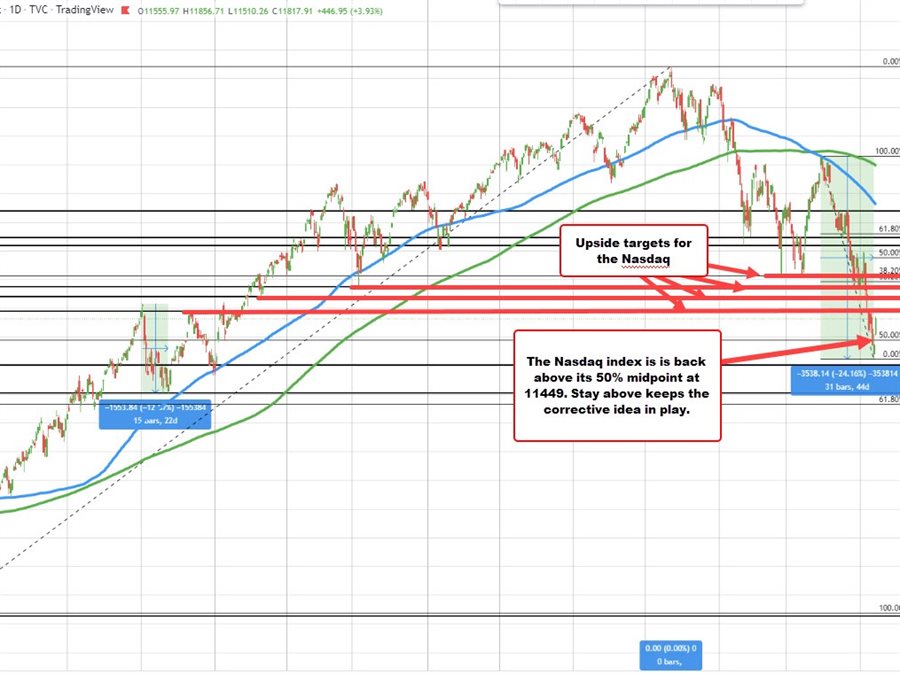

The Nasdaq is certainly leading the way to the upside, but it also has been leading the way to the downside. Since the March 29 high, the index lost 24.16% over 31 trading days (see chart above). That move started after the pair tested the 100 day MA (blue line in the chart above).

Technically, the low price yesterday moved below the 50% midpoint of the move up from the post-pandemic low. That level came in at 11449.29. The price gapped above that level today and has continued the short covering run to the upside.

The market has seen a sharp fall in a number of stocks and it is safe to say, a lot of money has been flushed out of the market and into cash. That may lead to some short covering as FOMO kicks in.

However, there is a lot of uncertainty with regard to inflation in the economy/earnings and Fed tightening that have to make it’s way into the market. Inflation may come down from the rises, but it does not mean that the price increases in 2022 will stick and sap consumer’s pocketbooks. Yes, they are spending on vacations and other events from the “pandemic holiday” that delayed those events, but what happens when the honeymoon is over?

I will be following the price action for clues and be cognizant of levels that are broken to the downside as well as targets to the upside. For the Nasdaq, moving back below the 50% midpoint would not be a good thing technically.

ON the topside, 11944, 12202, 12367 and 12573 are all upside targets for the Nasdaq index.