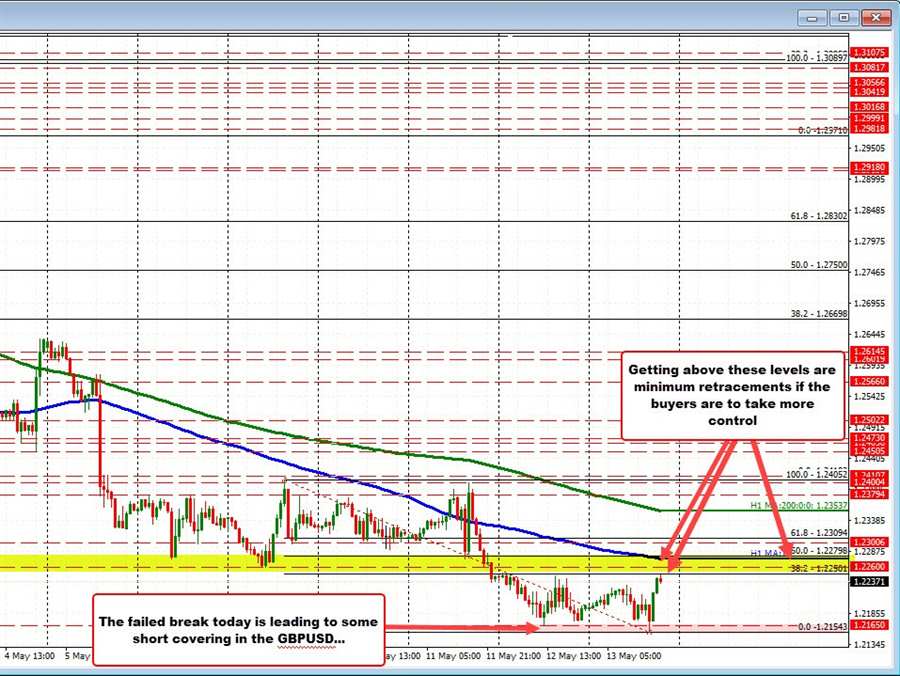

The GBPUSD is trading to a new session high and in the process has reached its 32.8% retracement of the week’s trading range. The high price came on Monday at 1.24052. The low price was today after the pair broke below the low from yesterday at 1.2165. The low price today reached 1.21543. That low broke below the lows for the year and also below lows going back to May 2020 – see post here)

The last 3 or so hours have seen the price move back to the upside. That rebound was helped by the failure of the new lows being made (sellers turned buyers on the failed break). A squeeze is on after the sharp move lower seen in 2022. The high from early January was up at 1.3747. The low was yesterday at 1.21543. That is a 1600 pip decline from high to low.

Going forward a move above the 38.2% retracement will be a further step in the short-term bullish direction, but there would still be more upside targets to get to and through. The low price from Monday at 1.2260 and the falling 100 hour moving average at 1.22742 would be the next targets. The 50% midpoint of the week’s trading range comes in at 1.22798.

Getting above those levels – and staying above – is the minimum if the buyers are to take back more control.