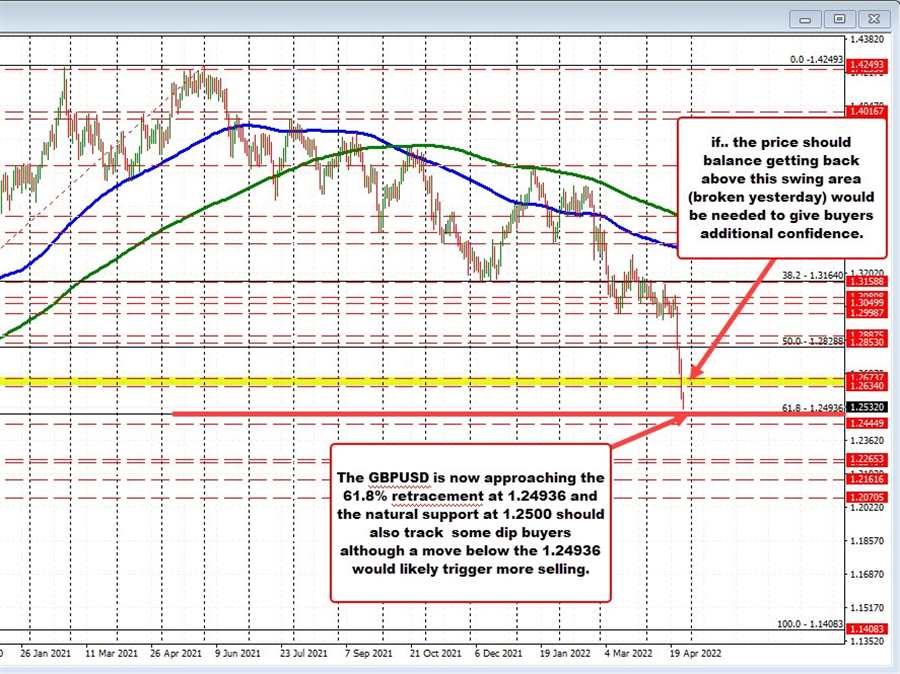

The price of the GBPUSD is trading near lows for the day at 1.2521. That is taking the pair closer to the natural support at 1.2500. It is also nearing the 61.8% retracement of the move up from the 2020 low at 1.24936.

Looking at the daily chart, the price moved below a swing area between 1.2634 and 1.26737 yesterday (see yellow area and red numbered circles on the chart above). On the daily chart it would ultimately take a move back above those levels to give the buyers more confidence. Holding the 61.8% retracement would be another potential boost – at least temporarily – for the pair.

Drilling down to the five minute chart in the GBPUSD below, the price action today has been more choppy after yesterday’s trend move to the downside.

The Asian session saw sideways trading that culminated in selling toward the start of the European session. Then a quick move to the upside saw the price extend above both the 100 and 200 bar moving averages (blue and green lines).

Traders hoping for a rebound tried to keep the GBPUSD above those moving average lines and push higher, but momentum faded and after the price move back below the moving average levels (the red shaded area in the chart below), and buyers turned to sellers.

A new low was made into the early US session. Since then a quick rebound back toward the moving averages found sellers once again before the price extended to new session lows. Bearish.

Overall there are lower lows intraday. Also the inability to get back above the 100 and 200 bar moving averages (with any momentum) in the New York session is a negative for the pair and keeps the sellers firmly in control.

The 1.2500 area remains the next target. Move below it increase the bearish bias.

Conversely, getting back above the 100 and 200 bar moving averages on the five minute chart would be needed to give the buyers some confidence, with the European high near 1.2600 as the next target to get to and through (near top of the red shaded area).

Absent that, and the sellers remain more (firmly) in control and the buyers are losing.

PS. The GBPUSD is now close to 600 pips down from its April 21 high (4-5 days ago). It is down over 1200 pips from its January high. The range for all of last year was around 1100 pips.

PSS The good news from the sharply higher dollar is it decreases the cost of imports. It also makes US exports more expensive all things being equal. Will that be a talking point for Fed officials? Generally they do not discuss the US dollar is that is in the control of the U.S. Treasury. However, if you want to paint a picture of inflationary pressures potentially moving lower, the sharp rise in the US dollar in 2022 is helpful.