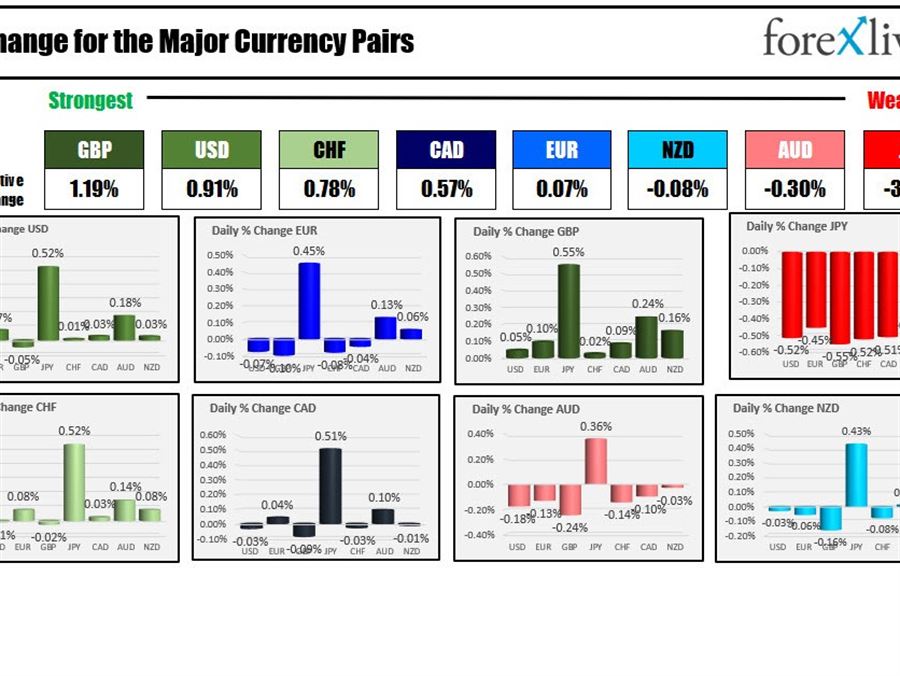

US and European markets (for the most part) are closed, but the forex market still trades. The GBP is the strongest and the JPY is the weakest. The major currencies are all clustered really close together with the JPY being the biggest outlier as it continued its move to the upside and trades to a new high going back to 2002. With US rates continuing to move higher, the spread to Japan equivalent yields remain elevated. Looking at the US 10 year yield verse the Japan 10 year yield, the spread is currently 253 basis points which is near the recent cycle high at 2.588% (which represents the highest level since April 2019).

Although the US stock and bond markets will be closed, the federal offices will be open. Just to prove it, the Federal Reserve has scheduled the release of industrial production and capacity utilization at 9:15 AM ET.

I looked back, and in December it was also released on a Friday, but looking back to September, the other release days covered every other day of the week. Thanks Federal Reserve. Go figure why it could not have been released on Thursday or Monday?

It also looks like the NY Fed Empire State manufacturing index for April will be released at 8:30 AM ET

The expectations for IP and Capacity Utilization are:

- capacity utilization 77.8 versus 77.6 last month

- industrial production 0.4% versus 0.5% last month

For the New York Fed Empire manufacturing index, it is expected at 0.5 versus -11.8 last month.

Bitcoin is trading (it never closes) and is currently trading at $40,235, up $321 on the day.