The US yields shot back higher after a brief hiatus over the last day or so on hopes that inflation had reached it’s peak. That was not the sentiment today as oil prices moved up to over $106 after being as low as $93.05 on Monday. The New York Times reported that the EU is moving towards adopting a phased in ban of Russian oil. In other commodity markets:

- Natural gas is also racing higher, reaching its highest level since November 2008.

- Corn is at its highest level since September 2012.

- Wheat is still off of its spike high (and was down today), but moved up for the last five trading days.

US import prices rose 2.6% versus 2.3% for the month. Import prices year on year up 12.5%.

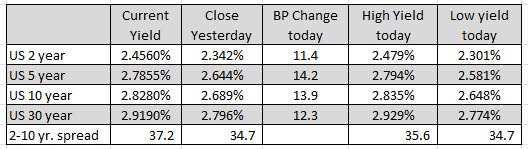

Looking at the US debt market today, the two year yield is up 11.4 basis points today while the 10 year yield moved up 13.9 basis points to a high yield of 2.835%. The high in the 10 year was just below the high from a few days ago at 2.836%. The 30 year bond meanwhile moved to its highest level since May 2019, reaching a high of 2.929%. The 30 year bond yield is getting closer and closer to the psychological 3.0% level.

The combination of the inflationary forces, has the dollar moving to the upside today. The strongest to weakest currencies shows the greenback leading the way higher while the CHF is the weakest.

Fundamentally today,

- The headline retail sales for March was a bit weaker than the estimate (0.5% vs 0.6% estimate), but the prior month was revised to 0.8% from 0.3%. Ex auto, the gain was 1.1% vs 1.0% with a revision to the prior month. A not so bright spot was that sales were boosted mostly by energy sales which moved higher due to higher prices. In fact excluding gas the retail sales would have been -0.3%

- Michigan consumer sentiment showed an impressive gain to 65.7 from from 59.7 last month. However, last month was at low levels. So the bounce is off a very low level

- What is indisputable is the Initial jobless claims that remain nearer low levels at 185K.

In Europe, the ECB kept rates unchanged and the pace of Asset Purchase Program along the schedule. ECBs Lagarde reiterated that the APP will likely end in the 3rd quarter but could not specify if that would be at the start or near the end. Furthermore the rate launch would take place after APP is concluded with a delay that could be a week or months. The rate path higher would be gradual with the ECB monetary policy dependent on incoming economic data, and the ECBs evolving assessment of the outlook.

When asked if the ECB was behind the curve in relation to other countries like the US, she said that comparing the economies are like comparing apples and oranges.

That more dovish/less hawkish bias helped to send the EURUSD to the lowest level since April 24, 2020 and below the lows from 2022 between 1.0805 and 1.0808, but the price did rebound into the close and is ending the day at 1.08264. Moving back below the 1.0800 level would be needed to kickstart more downside momentum going forward after the failed break.