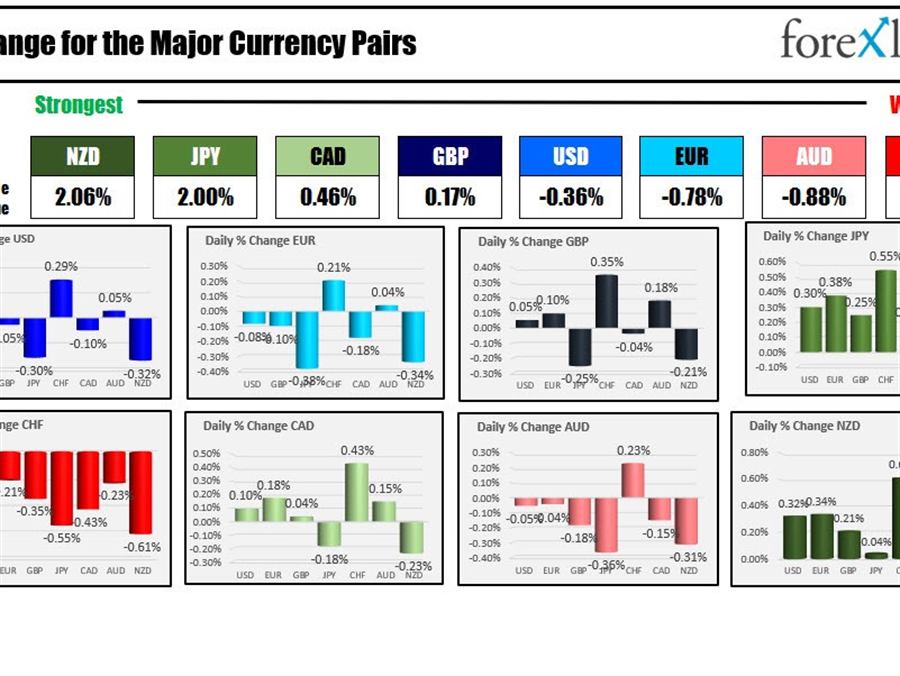

The JPY is the strongest and the CHF is the weakest as NA traders enter for the day.

The ECB kept rates unchanged and said that forward guidance remains the same. The APP will also remain unchanged with expectations for it to end in the 3rd quarter. The ECB will not raise rates until APP program is finished. There is no commitment to tighten policy sooner (which will all hinge on the APP purchases.

The EURUSD has moved lower on the headline news falling from 1.0913 to around 1.0865 currently.

The press conference with ECBs Lagarde will commence at the usual 8:30 AM ET and last for an hour with focus on the APP purchase trajectory. .

Also at 8:30 AM,

- The US will release the March retail sales report with expectations of 0.6% vs 0.3% last month. The core (ex auto) is expected to rise by 1.0% (vs 0.2% last month). Ex auto and gas came in at -0.4% last month (no estimate).

- The weekly US initial jobless claim data is coming off the lowest level since 1968 at 166K, is expected to rise slightly to 171K. The employment in the US remains very strong.

- US import and export prices for March are expected to rise sharply by 2.3% and 2.2% respectively in the global trade arena with oil and other commodities leading the way

- In Canada Manufacturing sales for February are expected to rise by 3.6% (last month 0.6%).

At 10 AM ET,

- Business inventories for February are expected to come in at 1.3% vs 1.1% in January

- U of Michigan sentiment index for April is expected to dip to 59.0 vs 59.4 in March. The data is the preliminary release for the month. The current conditions is expected at 68.0 vs 67.2 last month, and expectations are expected at 54.2 vs 54.3

Fed’s Williams, Mester and Harker are expected to speak today.

In other news, Elon Musk has put in a bid to buy Twitter since he does not have a lot to do. The non-binding proposal is for $54.20 per share. He would look to transform the firm as a private company. Shares at trading at $48.95 per share. Musk has a total net worth of $260B.

Citigroup earnings beat on the top and bottom line. Stocks are mixed with S&P and Nasdaq down modestly while the Dow is up modestly

In other markets:

- Spot gold is trading up $1.08 or 0.05% at $1978.60

- Silver is trading up down $-0.11 or -0.41% a $25.61

- WTI crude oil is trading down $0.56 at $103.72

- Bitcoin is trading at $41,020. That’s down around $125 on the day

In the premarket for US stocks, the major indices are mixed after sharp rises yesterday

- Dow industrial average is trading up 72 points after yesterday’s 344.25 point rise

- S&P is trading up down 3.64 points after yesterday’s 49.14 point rise

- NASDAQ index is down -6 points after yesterday’s 272.02 point rise

In the European equity markets, the major indices are trading higher

- German Dax, +0.5%

- France’s CAC, +0.6%

- UK’s FTSE 100 unchanged

- Spain’s Ibex, +0.4%

- Italy’s FTSE MIB, +0.4%

In the US debt market, yields are lower:

In the European debt market, the benchmark 10 year yields are mostly lower as well: