The FOMC meeting minutes sure made everyone look stupid.

The minutes showed that “many” (a couple or a few but many) thought at 50 BP hike appropriate. They also showed the Fed was ready to taper by $60B of treasuries and $35B of mortgage back securities.

What gets me is the Fed chair holds his presser after the rate decision, and doesn’t give an inkling of 50BP by ‘many’ or details about taper.

Admittedly, less than a week later he was much more hawkish during his congressional testimony (under oath?). Moreover, taper talk has been ratcheted up of late including from one of the more dovish members, Brainard yesterday. Makes you wonder if the Fed chair pushed her to say those comments about the balance sheet after he perused the meeting minutes ahead of release?

Aren’t the meeting minutes supposed to sort of reflect the press conference material or are the meeting minutes, the truth?

Anyway, the more hawkish slant today initially sent the dollar higher, stocks lower and yields higher?

Nope.

The initial moves were the exact opposite with the dollar lower, stocks higher and yields lower.

So it was a sell the rumour, buy the fact? Well, not exactly. That was the initial reaction.

Soon after, the initial reaction was over, the markets reversed with the dollar moving higher, stocks lower and yields higher, but then things reversed again, before the stupid traders – reacting to the stupid market – decided it is not worth it anymore and the currency prices started to settle near the middle of the high/low ranges (at least for now). Stocks and yields also settled. Phew.

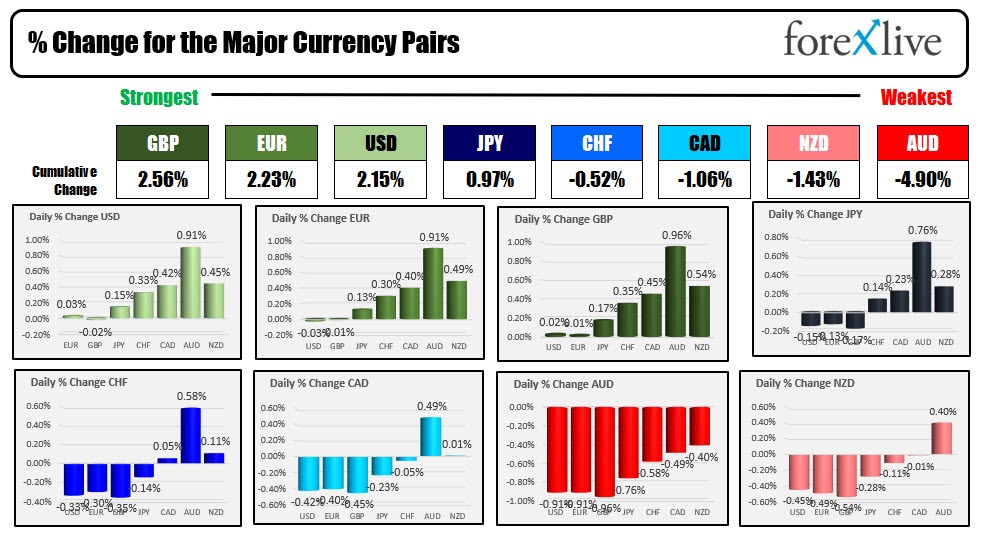

At the end of the day (or near the end) , the GBP, EUR and USD are fighting it out for the strongest currency of the day, while the AUD is the weakest.

The AUDUSD is looking to close below its 100 and 200 hour MAs at 0.7539 and 0.7521 respectively. On Thursday and Friday of last week, and again on Monday, the pair moved below those MAs, but moved back higher after modest breaks. Will the new day be able to keep the price below the level.

The EURUSD traded to the lowest level since March 8 today at 1.08736. The post-minute low stalled just above that level at 1.0878 before closing just below 1.0900 level. That 1.0900 level will be a barometer for buyers and sellers in the new trading day.

The USDCAD is closing for the first time above its 100 and 200 hour MAs since March 14. Those MAs come in at 1.2495 area. The price is trading at 1.2539 near the close. As long as the price can stay above the MAs, the buyers can further probe the upside.

In other markets:

- Gold is trading up $1.52 or 0.08% $1925.07

- Crude oil fell sharply today and trades at $96.80 down $5.14 or -5.04%. The EIA announced that members would release 120 million barrels over the next six months including the 60 million barrels announced by the US earlier this week.

- Bitcoin is trading lower at $43,842 down $1600 on the day

In the US stock market, the major indices close lower for the third consecutive day

- Dow industrial average -144.67 points or -0.42% at 34496.52

- S&P index -43.95 points or -0.97% at 4481.16

- NASDAQ index fell -315.34 points or -2.22% at 13888.283

- Russell 2000 fell -29.10 points or -1.42% at 2016.93

In the US debt market, the yields are ending mixed with the shorter end lower in the longer end higher.