Markets:

- Gold up $16 to $1935

- US 10-year yields down 5 bps to 2.43%

- WTI crude oil up $3.02 to $107.26

- S&P 500 down 29 points, or 0.6%, to 4602

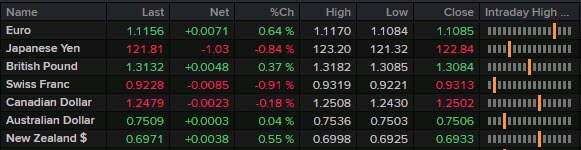

- JPY leads, USD lags

The inflation problems continue to mount for global central banks. The regional numbers were high so by the time the national German print rolled around, the market had a good sense it would be strong. The euro climbed for the second day, this time to above the March highs. That marks a 350 pip turnaround from the start of a month that saw the worst war in Europe in a generation.

In the FX market, the dollar slumped in the early going with GBP and the commodity currencies joining the euro in making headway. As risk appetite deteriorated, all of the gains and more were wiped out. USD/CAD fell as low as 1.2430 top make a new year-to-date low but turned around to finish at 1.2476.

Cable reached 1.3182 at the London fix but fell 50 pips from there. Despite that, it still finished up a half-cent on the day on the strength of gains in Asia and early in Europe.