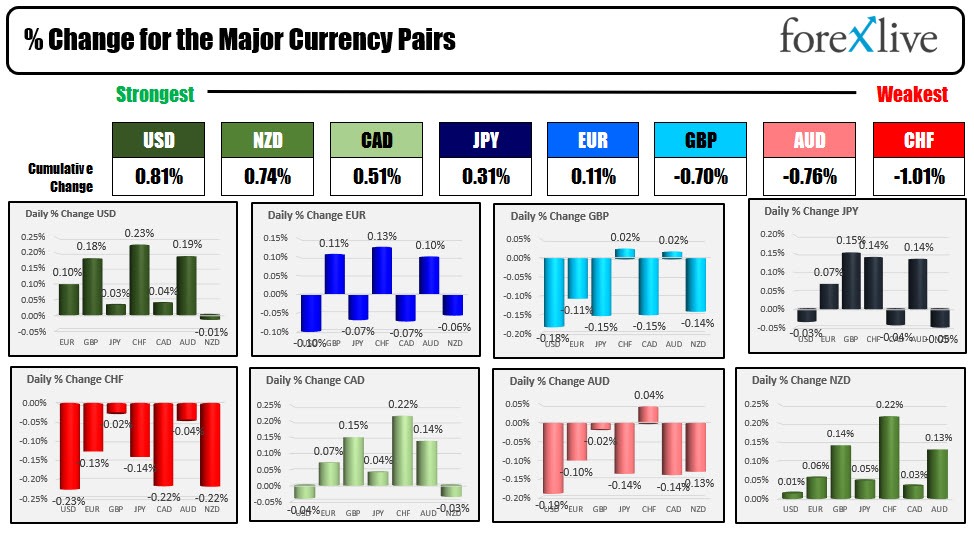

The trading week got off to a slow start in the FX. In the Asian session the USD is the strongest while the CHF is the weakest, but the currencies are relatively scrunched together.

The AUDUSD and NZDUSD were early gainers with the AUDUSD running to a high of 0.7424, but then rotated back down to a new low for the day at 0.73957. The NZDUSD saw it’s price move above its 200 day MA and extend toward the high for the year (and highest level since November 24), but the gain came up short of the March 7 high at 0.6925 (the high reached 0.69223), and it too moved back lower (to close support at 0.6899). It’s price is back below the 200 day MA which could be a problem going forward .

Crude oil moved higher helped by tensions in Saudi Arabia as Yemen Houthis fired missiles at energy and water facilities, and from the continued conflict in Ukraine. The Russian defense minister called on Ukrainian ‘nationalists’ to lay down their weapons (giving them to March 21 to do so) in Mariupol. They rejected their demand. The fight goes on. It is not pretty and does not seem close to being over either..

Also helping oil move higher was reports that the EU was mulling a Russian oil embargo this week.

Later today, US’s Biden, France’s Macron, Germany’s Scholz, Italy’s Draghi and UK’s Johnson will have a call to further discuss the Russian plan (11 AM ET). Later this week, Biden will travel to Brussels to meet with NATO leaders before heading to Poland to meet with Polands Duda.

- Hong Kongs Hang Seng gave up early gains and is trading modestly lower

- Shanghai composite is little changed.

- US e-mini S&P is down around -0.30%.

- Gold is up $7 or 0.38% at $1929.30

- Bitcoin is down -$841 at $40900

Japan was closed in observance of the vernal equinox. Happy spring to those in the northern hemisphere.