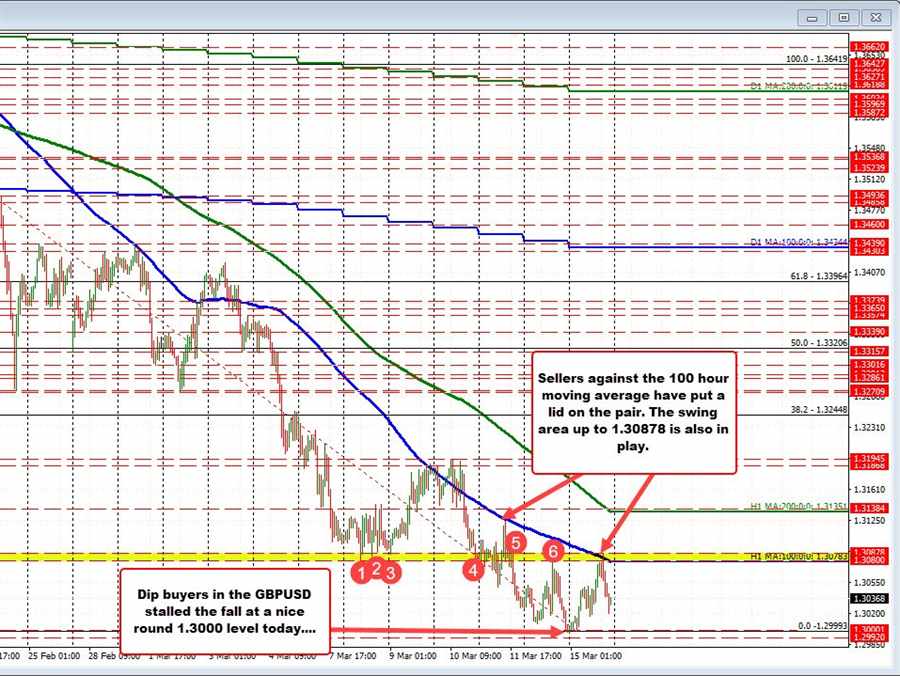

The dip buyers in the GBPUSD today bounced the price off /near a nice round natural support level at 1.3000 (the low reached 1.29993). The price moved higher into the North American session and approach the falling 100 hour moving average, and also a swing area between 1.3080 and 1.30878. The price was able to extend briefly above the 100 hour moving average, but moved up to the upper extreme of the swing area and found willing sellers.

Buyers turned sellers, and the last five or six hours has seen the price rotate back to the downside.

The current price trades at 1.3038 after reaching a afternoon session low at 1.3020.

What next?

Unfortunately, the story remains the same. The falling 100 hour moving average (blue line in the chart above) along with the swing area up to 1.30878 needs to be broken if the buyers are to take more control.

Absent that and the downside remains the dominant bias. On the downside the 1.3000 level remains a natural support target. Move below that level, and the sellers can probe further.