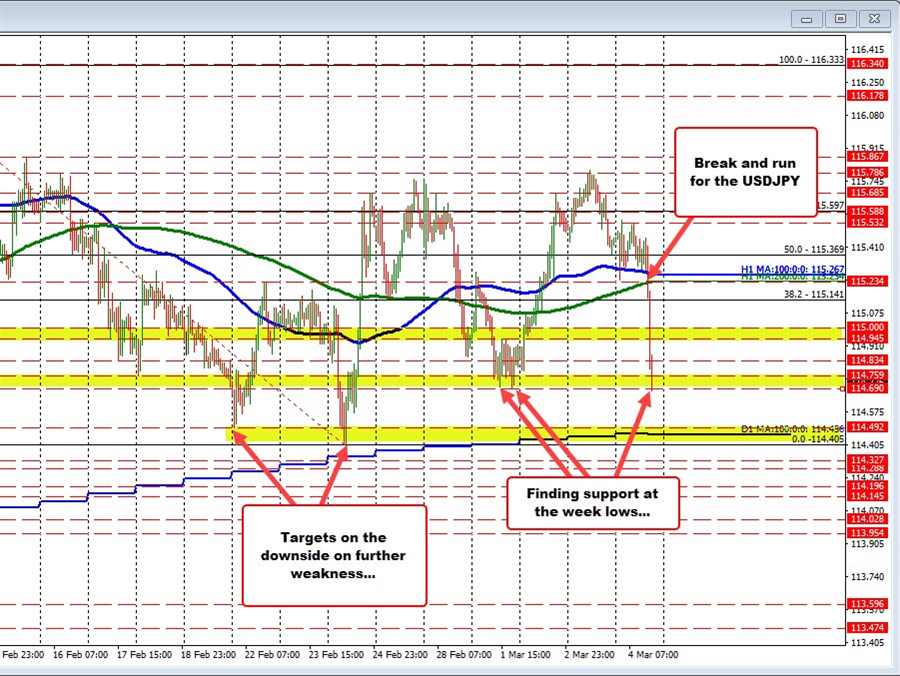

The USDJPY has ticked to a new week low taking out the lows from Tuesday near 114.69. The not so good news is the low price just reached 114.68. That may disappoint sellers and lead to corrective probing. A move back above 114.85 will be eyed. Move above and we could see more upside corrective probing now.

Earlier today in a post, the pair was testing the 100/200 hour MAs. I wrote at the time:

“A move below the 200 hour MA would increase the bearish bias for the pair with the broken 38.2% of the move down from the Feb 10 high at 115.14 as the next target, followed by the 115.00 natural support. A swing area cuts across at 114.945 to 115.00 as well. Move below those levels and the door opens for more downside momentum.”

All those targets were broken, and it did open the door for more selling. The low for the week is the natural next target. Move below it, and traders will next be focused on the lows from last week at 114.492 and 114.405. Between those levels is the 100 day MA at 114.43.

It is Friday, and tensions remain at “red hot” levels over the weekend.

The US stocks are off lows but are still showing:

- Dow -436 points or -1.26% at 33371

- S&P -62 points or -1.41% at 4302.04

- Nasdaq -251 points or -1.86% at 13284

In the US debt market, yields are sharply lower with the 10 year down around 14 bps. That too is helping the USDJPY sellers today.