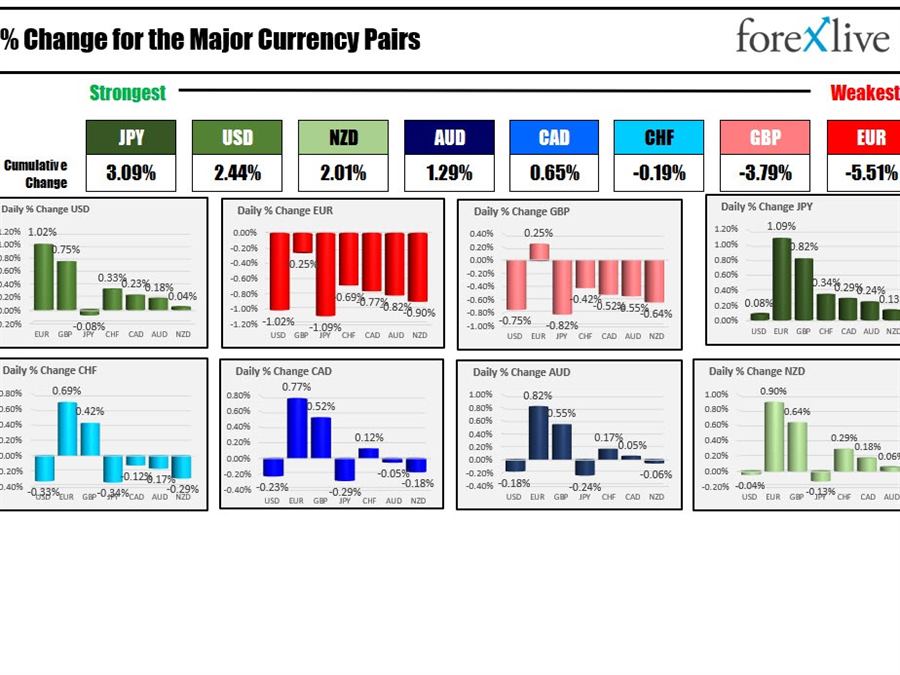

The JPY is the strongest and the EUR is the weakest as European traders look to exit.

Taking a quick look at some of the technicals for the major currency pairs:

- USDJPY : The USDJPY is lower on the day and in the process moved below a swing area between 114.759 and 114.834. The low price reached 114.703. The current price is trading at 114.897. Moving back below the 114.759 level would increase the bearish bias and have traders looking toward the swing low from February 22 at 114.492 followed by the 100 day moving average at 114.405. On the topside, the 115.00 level is the first upside target followed by the falling 200 hour moving average at 115.08. The 100 hour moving averages cuts across at 115.193 and would be another target to get to and through if the buyers are to take more control. The price has not traded below its 100 day moving average since September 23, 2021.

- EURUSD : The EURUSD moved to a new 2022 low as European traders exited for the day. The move took out the low from last week at 1.11056. The pair is trading to a new session low of 1.1091 as I type. With the pair trading at the lowest level since May 2020, traders will look toward resistance as the guiding light for the short term technicals. Staying below the swing low from January 28, 2022 at 1.11207 would keep the sellers firmly in control. Move above and there could be a slowing of the downward momentum as traders become disappointed on the break lower. There is not a lot of support until the 1.1018 level which was near swing highs going back to May 2020

- GBPUSD. The GBPUSD is also trading to new session lows as traders exit for the day and Europe. The low price just reached 1.3308 and in the process moved below the low price from yesterday at 1.33157. Earlier, the price fell below the swing low levels from the end of January between 1.33574 and 1.33739. Admittedly that area was broken on Thursday of last week and again yesterday, but the price snapback higher and above that swing area. This is the third move below that swing area, and traders will once again be using it as a risk defining level. Stay below 1.3357 – 1.33739 and the sellers are firmly in control. The low price from last Thursday at 1.3272 is the next major target.

- AUDUSD: The AUDUSD has moved to a new session low of 0.72414. In the process, the price is getting closer to the 100 day moving average at 0.72358. Recall from going back to February 10, February 23, and February 25, the price tested the 100 day moving average and found sellers. There was a break above on February 23 which moved to a high of 0.72831, but the break only lasted around 12 or so hours. Yesterday the process broke above the MA again and made a new high for the year at 0.7289 during trading today. However all the gains today have been erased and the 100 day moving average is back in play. Move back below the 100 day moving average and the selling could intensify with the 100 hour moving average at 0.72135 and the 200 hour moving average at 0.7210 as the next downside targets.

This article was originally published by Forexlive.com. Read the original article here.