US stock losses have accelerate to the downside into to the day close. Some of the negative highlights for the day.

- The Nasdaq is down near 2.8%

- S&P tech sector down near 3%

- The major indices are down for the week

- Dow has it’s worst day in 2022

- Nvidia falls -7.5%

- AMD -4.47%

- Paypal -4.8%

- Microsoft -2.92%

- Meta down -4.0%

Ouch…

The final numbers are showing:

- Dow fell -623 points or -1.78% at 34311

- S&P -94.99 points or -2.12% at 4380.03

- Nasdaq -407.37 points or -2.88% at 13716.72

- Russell 2000 -51.21 points or -2.46% at 2028.09

European shares were also lower on the day. Below are the statistics for the day for the major US and European indices.

The moves lower in stocks led to other markets following the “risk off” theme.

- Gold is up $29 or 1.56% at $1898.17

- Yields are lower with a decline of -6.7 basis points to 1.975%

- Oil fell to $90.02 in the April contract which was down -1.79% on the day (that despite the risk in Ukraine)

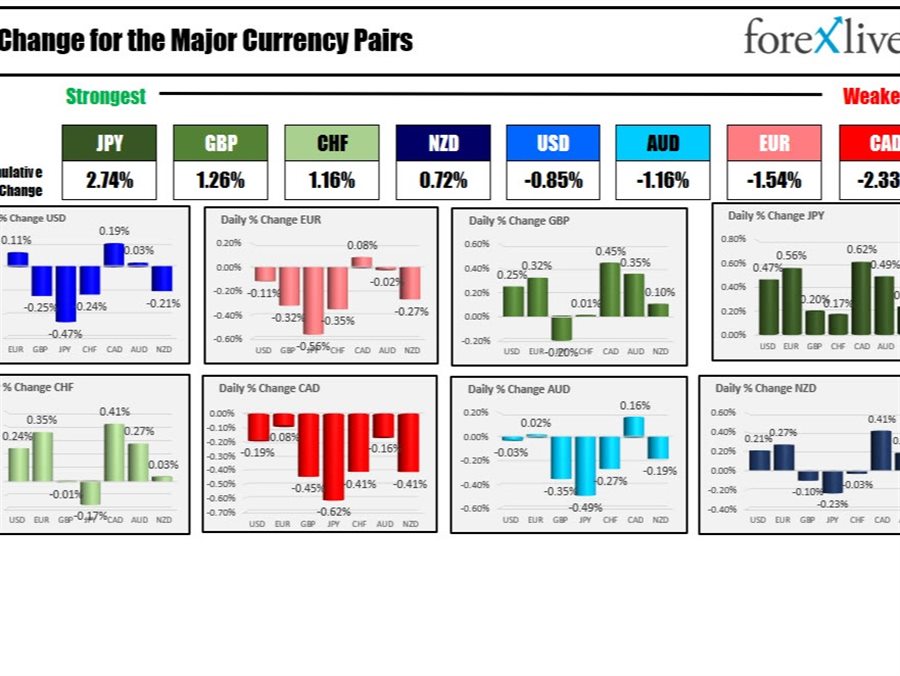

In the forex, the JPY was the strongest and the CAD was the weakest. The EUR moved lower but it wasn’t a rout to the downside. The AUD was marginally lower as well despite the greater than -2.18% declines in the broader indices. The USD was mostly lower but gained vs the EUR and CAD. It was unchanged vs the AUD.

This article was originally published by Forexlive.com. Read the original article here.