The US jobs report expectations was tilted to the downside pre-report as a result of omicron and all the premarket data. However it came in much stronger than expected at 467K versus 150K estimate. The two month revision was a whopping +700K. What?

What has been the fallout from the surprise gains?

- US stocks in premarket trading have moved lower. The Dow industrial average is now down -183 points. The S&P is down -19 points and the NASDAQ has turned negative at -57 points.

- US yields are higher. The two year yield is up 8.4 basis points to 1.275%. The 10 year is up 6.9 basis points to 1.896%.. The market is pricing in a better chance of a 50 basis point hike at the March meeting

- Crude all moved up to a new seven year high of $92.44. It has since rotated back to the downside and currently trades at $91.92 that still up $1.65 or 1.83%

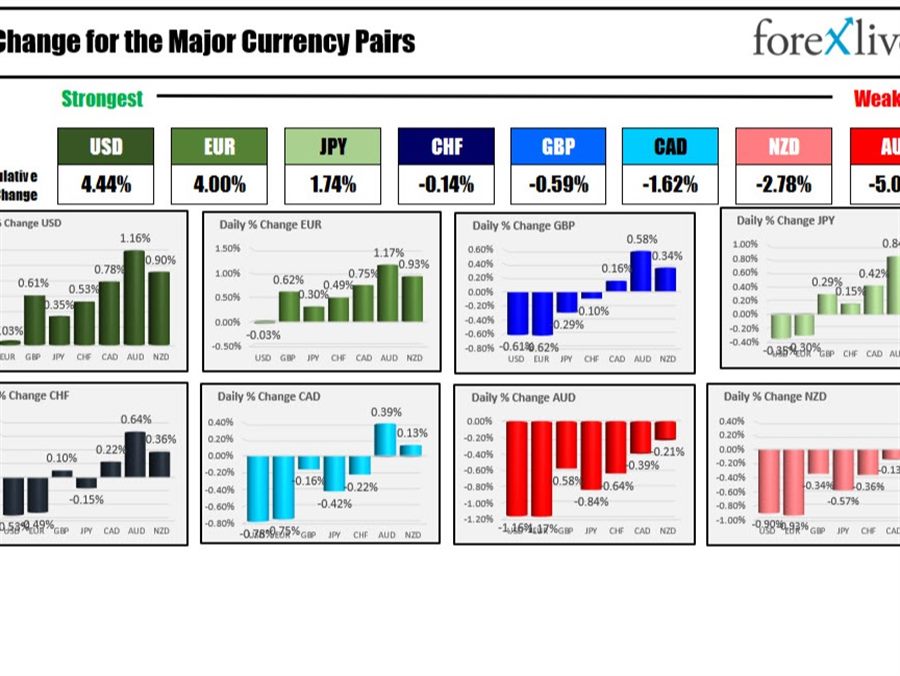

- The US dollar has moved higher and is now the strongest of the major currencies.

Highlights in currencies:

- The EURUSD has moved back down to test its 100 day moving average at 1.1427 area. The low reached 1.1421 before snapping back marginally to 1.1439 currently. The high price today stalled near the highs from January at 1.1482. The buyers and sellers will now fight it out between the 100 day moving average and the high from January.

- GBPUSD was week on the day coming into the report and has moved down to test its 100 day moving average near 1.3507. The low reached 1.3504 so far. The 100 hour moving averages at 1.35298. And the snapback off of the low has so far stayed below that level. Buyers and sellers are battling between the 100 bar moving averages (daily and hourly). A move below would target the 200 hour moving average at 1.24855 move below that and it opens the door for further downside. On the topside the 50% midpoint of the 2022 range comes in at 1.35526.

- The USDCAD moved higher after the weaker than expected Canada jobs report and the stronger than expected US jobs report. The price moved up to test the highs from January between 1.2774 and 1.27958. The high price reached 1.2787 and has backed off a bit. At the lows this week, the pair made a nice floor between 1.26496 and 1.26628 (the 38.2% retracement is also at 1.26628 – see green numbered circles). Traders will now watch 1.27475 now for intraday support. That level was a swing high on January 27 and early January 28 as well as a swing low on January 28 (see blue numbered circles in the chart below). Stay above and the buyers remain in control.

This article was originally published by Forexlive.com. Read the original article here.