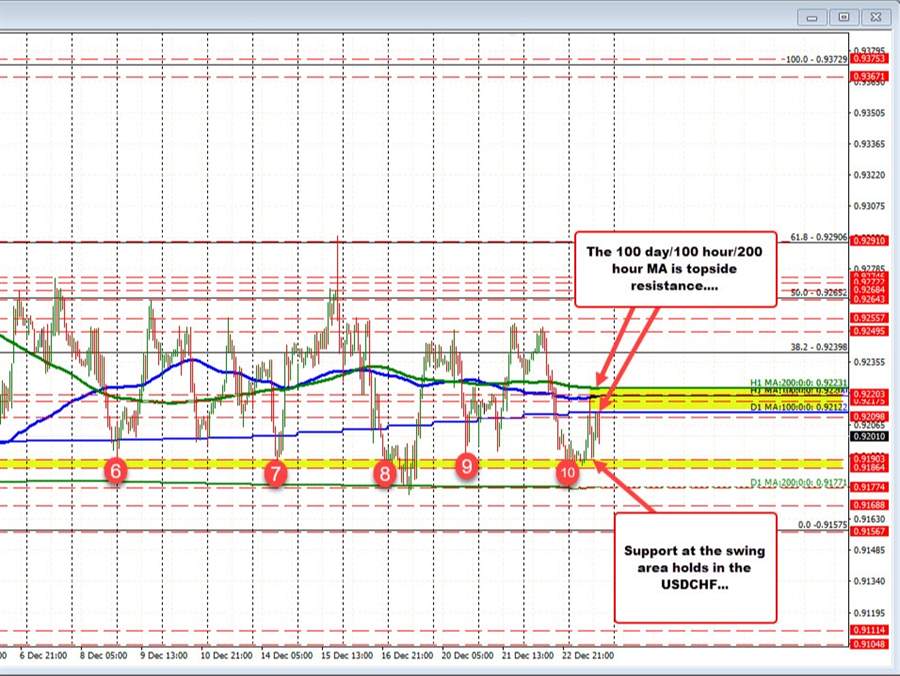

The USDCHF fell below its 200 hour, 100 hour and 100 day moving averages yesterday but bottom near a swing area between 0.9186 and 0.9190.

Today that swing area was respected again at the session lows. The price moved higher and was able to get above the 100 day moving average at 0.9212, but stalled right at the 100 hour moving average currently at 0.9220. The 200 hour moving averages just above that level and 0.92231.

The subsequent fall took the price back down toward the swing area below but once again found support. The rise back higher is now finding resistance against the lower 100 day moving average at 0.92122.

So the theme is up and down, with downside respect against the swing area at 0.9186 to 0.91903 and upside respect against resistance at the 100 day moving average/100 hour/200 hour MAs.