There’s still much uncertainty on how omicron is going to play out but the general line of thinking now is that things won’t be as bad as last year. However, there is some room for caution as vaccines are seemingly less effective and the virus strain is more highly transmissible.

So, how does all of that translate into impact to the global economy?

In all likelihood, we’re not going back to the kind of lockdowns that we experienced last year. It’s just not going to happen – at least in the US and Europe. That said, restrictive measures may be needed (though not without some social uproar).

Given that scenario, growth conditions are likely to slow as we come to terms with omicron but they should pick up again as we head towards Q2 2022 and most likely by 2H 2022.

I mean central banks are already on course to tightening further so expect that to still be the case next year unless the recovery gets derailed completely, which isn’t going to happen. Not to forget that with inflation still running rampant, policymakers don’t really have a choice to stay pat in the year ahead.

The real question mark in all of this is of course China but that aside, things may be more straightforward as outlined above.

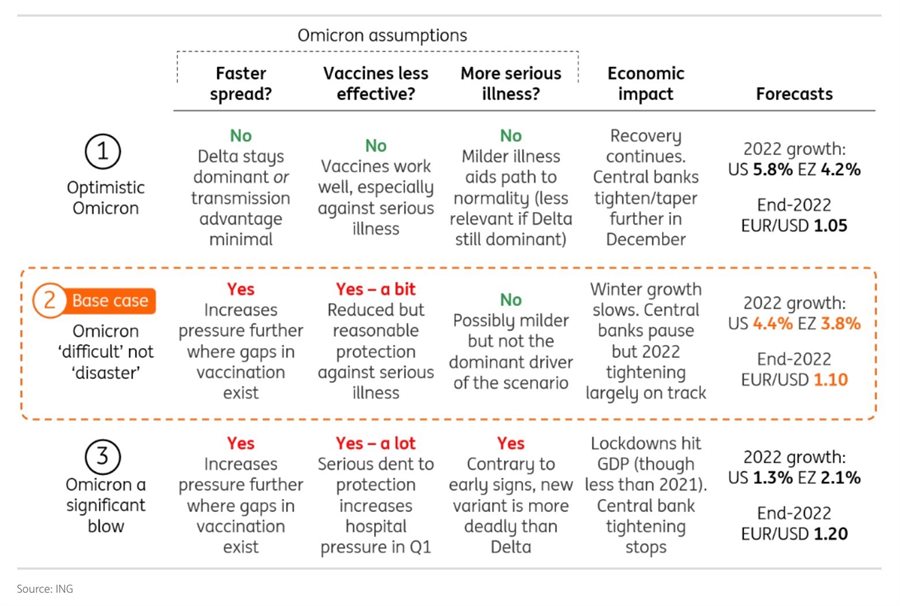

Here’s a neat little crib sheet put out by ING on some scenarios to consider: