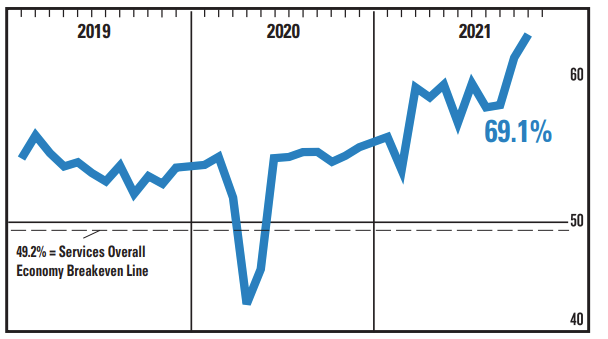

ISM services PMI index for November

- prior month 66.7

- new orders 69.7 versus 64.0 estimate. Last month 69.7

- employment index 56.5 versus 52.2 estimate. Last month 51.6

- prices paid 82.3 versus 80.9 estimate. Last month 82.9

- business activity 74.6 versus 69.8 in October

- supplier deliveries 75.7 versus 75.7 last month

- backlog of orders 65.9 versus 67.3 last month

- new export orders of 57.9 versus 62.3 last month

- imports 50.5 versus 53.3 last month

- inventory sentiment 36.4 versus 37.3 last month

Some highlights:

- The index is the highest reading since the

inception of the index in 2008. - The 12-month

average is 62.1 percent, which reflects strong

and sustained demand in the services sector. - The November reading indicates the services

sector grew for the 18th consecutive month

after two months of contraction and 122 months of growth before that.

Anthony Nieves, chair of the ISM services business survey committee said:

Economic activity in the services

sector grew in November for the

18th month in a row – with the

Services PMI® setting a record for

the fifth time in 2021 – say the

nation’s purchasing and supply

executives in the latest Services

ISM Report On Business.

In November, the Services PMI®

registered another all-time high of

69.1 percent. Demand continues

to be strong, reflected by subindex

data in November. The Backlog

of Orders Index registered 65.9

percent, 1.4 percentage points

lower than October’s all-time high

reading of 67.3 percent. Services

businesses continue to struggle

replenishing inventories, as the

Inventories Index (48.2 percent, up

6 percentage points from October’s reading of 42.2 percent) and

the Inventory Sentiment Index (an

all-time low of 36.4 percent, down

0.9 percentage point from the previous month’s figure of 37.3 percent)

stayed in contraction or “too low”

territory in November.

All 18 services industries

reporting growth in November –

listed in order – are: Real Estate,

Rental & Leasing; Transportation & Warehousing; Retail Trade;

Agriculture, Forestry, Fishing &

Hunting; Management of Companies & Support Services; Utilities;

Wholesale Trade; Mining; Public

Administration; Construction; Health

Care & Social Assistance; Arts,

Entertainment & Recreation; Other

Services✣; Professional, Scientific

& Technical Services; Finance &

Insurance; Information; Educational

Services; and Accommodation &

Food Services.

Like the Markit report, it is likely most of the survey data was collected before the recent omicron news.