Frong-end of the bond market in charge

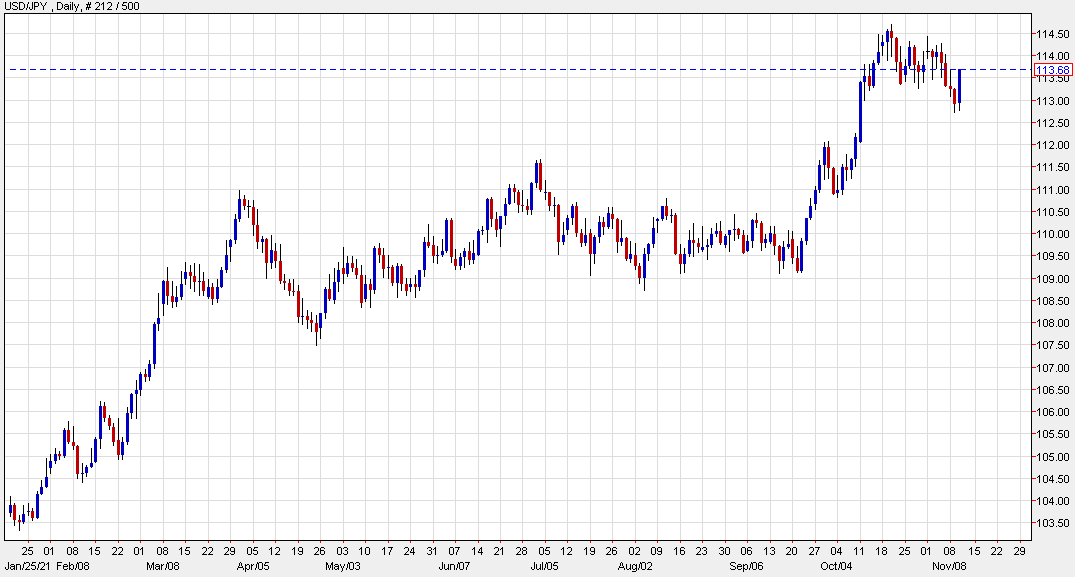

USD/JPY is at the highs of the day, up 77 bps to 113.64.

There’s an element of the Fed losing control of the narrative here. USD/JPY and US rates had been falling since the FOMC as officials pushed back on inflationary fears and underscored their reasons that inflation would be transitory. That’s a tougher argument to stick with when inflation prints continue to rise, especially core inflation.

The bond market is following that script with US 2s up 9 bps to 0.50% and 5s up 10 bps to 1.17%. As those rise, USD/JPY is rising at the same time as yield differentials expand.

That could be the end of the USD/JPY retracement (and the broader yen bounce).

This article was originally published by Forexlive.com. Read the original article here.