The price action remains choppy, but the pair is following the USD.

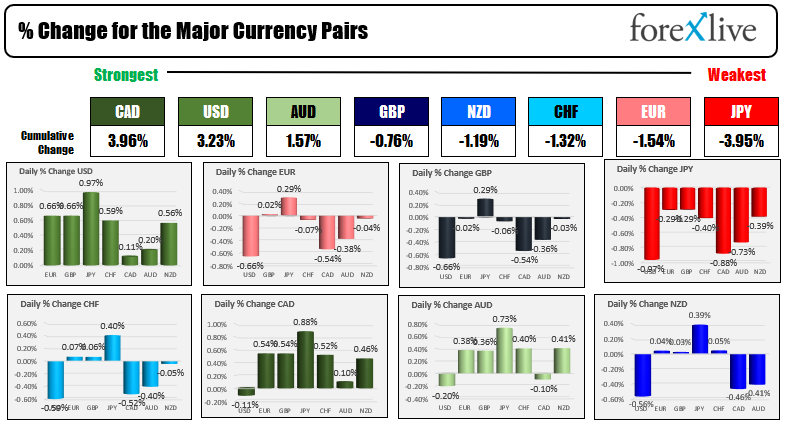

As London/European traders head for the exits, the USD is just behind the CAD as the strongest of the major currencies. The JPY is the weakest.

The next target comes in at the low from Monday at 1.34493. Below that sits the MOST RECENT cycle low at 1.34236. That low is still just above the low for 2021 at 1.34112 reached back on September 29. Note that between September 29 and November, the pair moved all the way up to 1.38337 reached on October 20 before moving back down to 1.34236. Putting it another way, that is 423 pips higher in around 15 days, followed by about 410 pips lower in about 12 days (to the low reached on Friday).

1. Not being able to crack through the next targets at 1.3449, 1.34228, 1.34236 an then the lows from the end of September down to 1.3411 to 1.34149.

2. Moving back above 1.3503 to 1.3509. That represents the swing highs from Friday before and after the break to the November swing low.