USD strength and oil giving back gains are factors

Watching the oil market in the past week weeks, there’s been a clear pattern of selling early in US trading only for the buyers to return late in the day.

That pattern fits with specs selling at the most-liquid time and refiners buying dips but you could argue that producers are hedging into high liquidity, even though they’ve been crushed on hedges this year.

In any case, that’s a pattern to continue to watch with oil down to $84.70 from a high of $85.38 a short time ago.

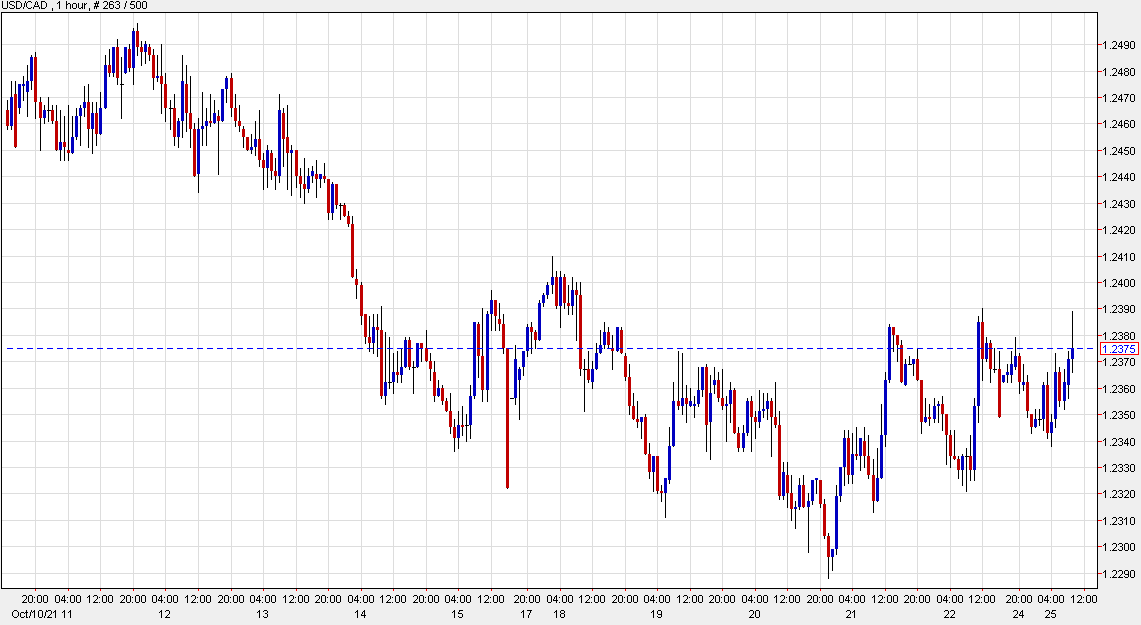

The US dollar is also broadly bid as the risk trade wobbles. USD/CAD tried Friday’s high of 1.2390 but has been beaten back on the first look. That area around 1.24 has proven to be tough resistance in the past week but it’s also been impossible to get momentum going to the downside despite runs in energy and commodities.