What are the charts saying for the EURUSD in the new trading week.

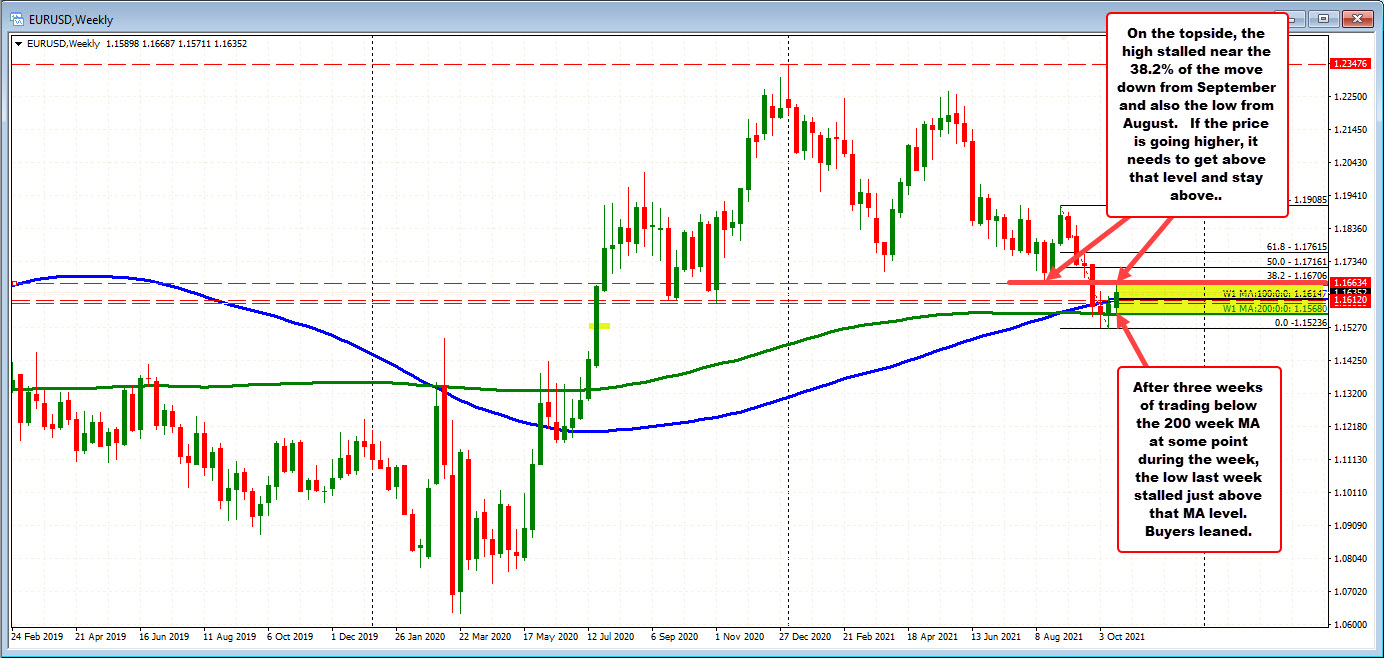

The EURUSD traded below the 200 week moving average over the prior 3 trading weeks. Each of those weeks could not close below that MA level. In fact, the last 3 weeks closed between the 100 week MA above (blue line in the chart above) and the 200 week MA below (see green line in the chart above).

In the October 18 to October 22 trading week, the 200 week MA came in at 1.1568 while the 100 week moving average came in at 1.16147. The low for the week came in at 1.1571 – 3 pips above the 200 week MA level.

Did buyers lean against the 200 week MA level at the lows?

It sure seems that way.

That low was on Monday and looking at the hourly chart below, the low also stalled at the 200 hour MA (green line in the chart below) at the same time. There were TWO good reasons to buy and buyers obliged/leaned. They pushed the price higher.

The other key level on weekly chart was the 100 week MA at 1.16147.

On Monday, that MA was rebroken to the upside, corrected to 1.16067 at the end of day and raced back above the 100 week MA to the high for the week at 1.16687 on Tuesday. That high stalled just ahead of the 38.2% of the move down from the September high at 1.16705 (you can see that retracement on the weekly chart).

If buyers leaned against the 200 week MA, they seemed to have also leaned against the 38.2% retracement of the move down from the September high.

So the week range, was influenced by technical support below (200 week MA) and technical resistance above (the 38.2% of the move down from the September high.

What about the new week?

In the new trading week, focus on the down side needs to be at near the 100 week MA level (likely to be around 1.1619 in the new trading week). That level also corresponds nicely with the post Tuesday swing lows at 1.1616 on Tuesday and 1.16185 on Friday. The cluster of those levels should be a barometer for the buyers and sellers. Stay above 1.1616-1.1619, more bullish. Move below, more bearish.

The current price near the close for the week is at 1.1640.

On the topside, although traders made a mess of the 100 hour MA on Thursday and Friday, if traders get a feeling on which way it wants to go, it will start to move away from that MA at 1.1638 currently. From there getting above 1.1656-58 would be the next step before the pair tackles the highs from Tuesday and Thursday at 1.1666 to 1.16687 and the 38.2% retracement at 1.1670.

Get above 1.1670 and we should see further buying momentum.