The USD is weaker on “risk on’ flows.

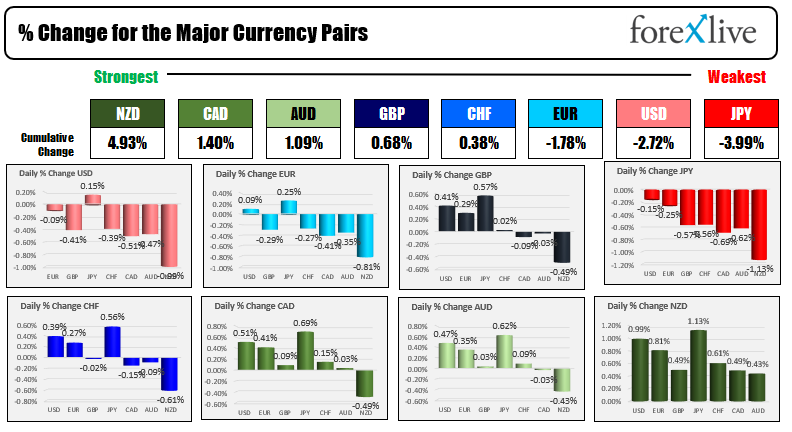

As the North American session begins, the NZD is the strongest of the majors, while the JPY is the weakest. The USD is also weaker as “risk on” flows dominate. US stocks are higher in premarket trading Citigroup just announced earnings and beat on both the revenues and earnings per share. The US/European yields are lower. The 10 and 30 year bond auctions this week attracted strong international demand. US PPI data will be released along with the weekly jobless claims and oil inventory data. The speaking circuit is chockablock with Fed officials including Bowman, Bostic, Bullard, Daly, Harker.

In other markets as US trading gets underway:

- Spot gold is up $3.40 or 0.17% at $1796. The high price did extend just above the $1800 level to $1800.50, but backed off.

- Spot silver is up $0.17 or 0.67% at $23.24

- WTI crude oil futures are up $0.90 or 1.12% $81.34

- Bitcoin is trading at $380 and $57,757

In the premarket for US stocks, the major indices are trading higher after the S&P and NASDAQ index snapped their three day decline yesterday. The Dow industrial average closed fractionally lower and has been down for straight days now.

- Dow +305 points after yesterday’s -0.53 point decline

- S&P index +44 points after yesterday’s +13.15 point gain

- NASDAQ index +173 points after yesterday’s 105.71 point rise

In the European equity markets, the major indices are also up smartly:

- German DAX +0.9%

- France’s CAC +1.0%

- UK’s FTSE 100 +0.8%

- Spain’s Ibex +1.0%

- Italy’s FTSE MIB +1.1%

In the US debt market, yields are lower across the board with the 10 year down -1.9 basis points. The five year yield is down -2.4 basis points:

In the European debt market, the benchmark 10 year yields are also lower. German 10 year yields which got within about eight basis points of parity this week are trading back at -0.163%.