Forex news for North American trade on Friday, October 8:

Markets:

- Gold up $1 to $1756

- US 10-year yields up 3.6 bps to 1.606%

- WTI crude oil up $1.19 to $79.49

- S&P 500 down 8 points to 4391

- CAD leads, JPY lags

The jobs report put a focus on the US dollar and the initial reaction was 20-40 pips of US dollar selling but beneath the surface there were enough caveats and silver linings to keep that trade in check.

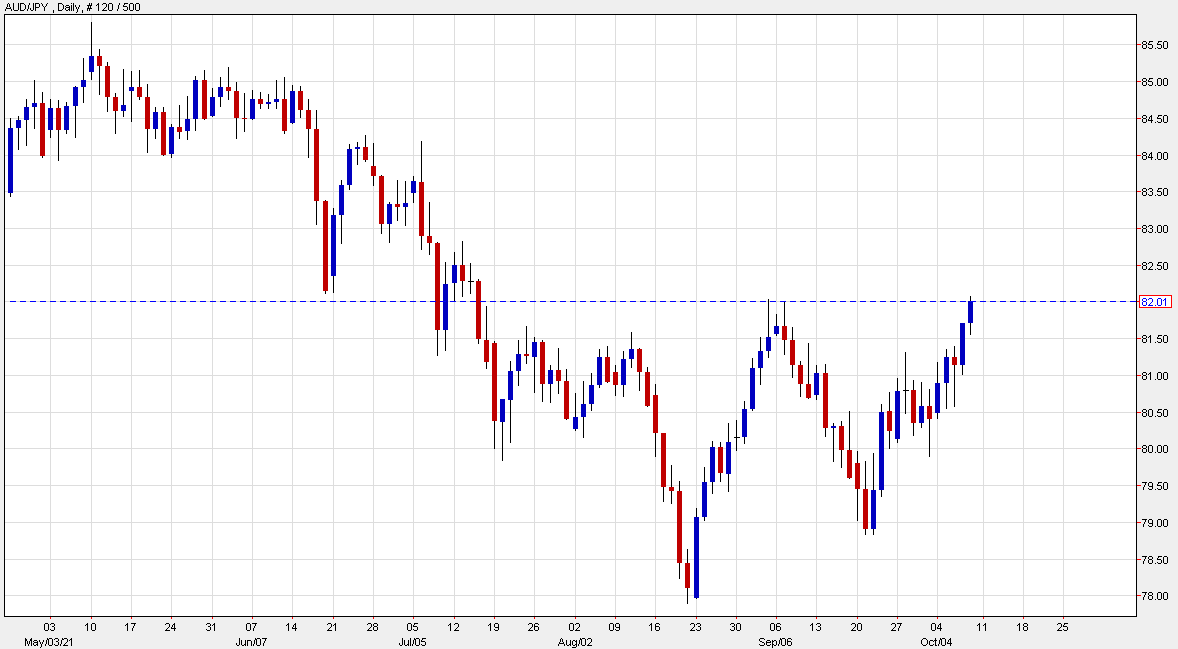

The real price action has shifted to the yen as it was once again softened. That came in an environment of rising rates and a middling risk trade overall. Technically, the moves in USD/CAD and CAD/JPY are increasingly compelling and now AUD/JPY (below) is having a look at the August highs, edging above on Friday.

The loonie was the big winner on Friday and that’s no surprise given that Canada added as many full time jobs as the US added total. That sent USD/CAD down to a two-month low. Of course, WTI hitting $80 for the first time since 2014 didn’t hurt.

Intraday trading was choppy in EUR/USD as it ranged between 1.1560 and 1.1580 several times. The euro did manage to squeeze out a small gain as it looks to stop the bleeding but there isn’t much in the way of technical support.

CFTC positioning data showed USD longs are at the most extreme since June 2019, so there isn’t much low hanging fruit left.