NASDAQ recoups 1.25%

The NASDAQ index yesterday took on the chin with a decline of -2.14%. Today the index recouped 1.25% of that decline but it could’ve been better. The index was up as much as 1.78% intraday. It is closing up 1.25% on the day.

Some highlights:

- Dow industrial average recouped all of the declines from Monday’s trade

- NASDAQ index has the best day since August 23

- NASDAQ is still 6.29% below the all-time high. At the low, reached yesterday, the price moved -7.93% from the high

- S&P index is 4.4% below the all-time high. At its low reached yesterday the index fell -5.87%

- The Dow industrial average is down -3.68% from its all-time high

A look at the final numbers shows:

- Dow industrial average rose 3 and 11.73 points or 0.92% at 34314.68

- S&P index +45.24 points or 1.05% at 4345.71

- NASDAQ index up 178.36 points or 1.25% at 14433.84

The major indices were buoyed by some short covering and dip buying. Having said that, the S&P index intraday moved back above its 100 day moving average at 4351.31. However the momentum could not be sustained, and the price moved back below that moving average level. For the NASDAQ index, it’s high price reached 14508.65. That was short of the 100 day moving average at 14521.12.

If the technical bias is to turn more positive, getting back above those 100 hour moving averages is required.

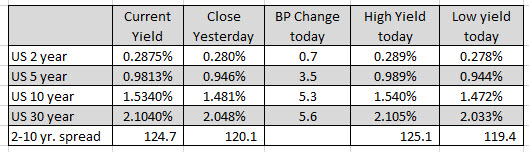

Other non-supportive fundamentals was the rise in rates today. The 10 year yield moved up 5.3 basis points and the 5 year moved back closer to 1.0% (currently at 0.9813%).