Brent threatens to take out the June high

The high in Brent today is $77.83, which is just one cent shy of the $77.84 high in June.

It’s an interesting contrast to WTI, which is $3.30 away from the June high.

Talk of gas-to-oil switching in power plants is helping brent to widen the spread to WTI. So is the improvement in European growth. Historically, a $7-8 spread isn’t unusual owing to more-abundant North American supplies.

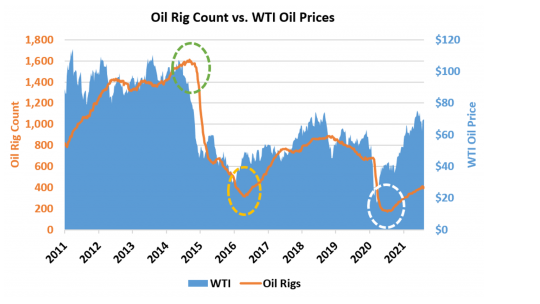

Oil and gas producers are spending just $0.27 in 2021 for every $1.00 in investment they made in 2014, when oil was $100/bbl, and $0.58 for every $1.00 in investment in 2018, when the oil price was comparable to today’s.

The theme of capital spending discipline is strong in oil right now and is the big one to watch in the next month, as major E&Ps set budgets for 2022. I expect to see some uptick in activity — if only to keep US production flat — but the days of ‘drill baby, drill’ are long gone.