A look at the market moves

The S&P 500 has pared some of today’s decline, rising to 4456 from 4443 at the lows. That improvement is spilling over to FX as well as the ‘risk off’ trade fades.

This is increasingly looking like an ‘inside day’ where US equities and other assets trade inside of the prior day’s range. In general, days like that are more ‘noise’ than ‘signal’.

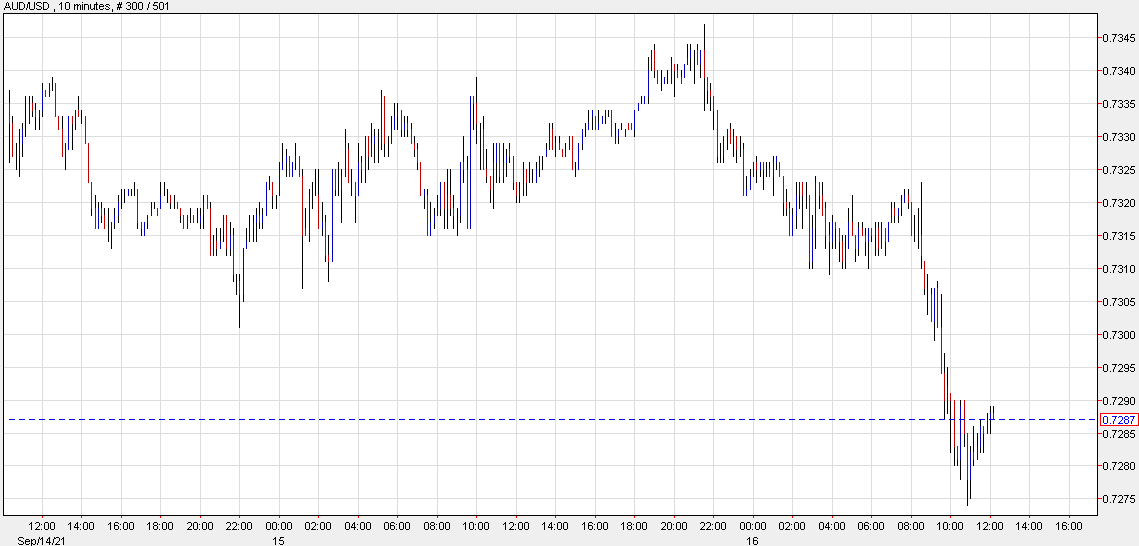

If we see this price action continue, the better bets are retracements in some of the larger moves. One of those is AUD/USD. The Aussie is the laggard today and trying to perk up, so far unsuccessfully.

Swiss franc crosses are also candidates for rebounds.

The risk is that this is a mid-day bounce that will evaporate later in the day. But in AUD/USD, it’s still so close to the lows that the risk-reward with a stop on the lows is attractive.