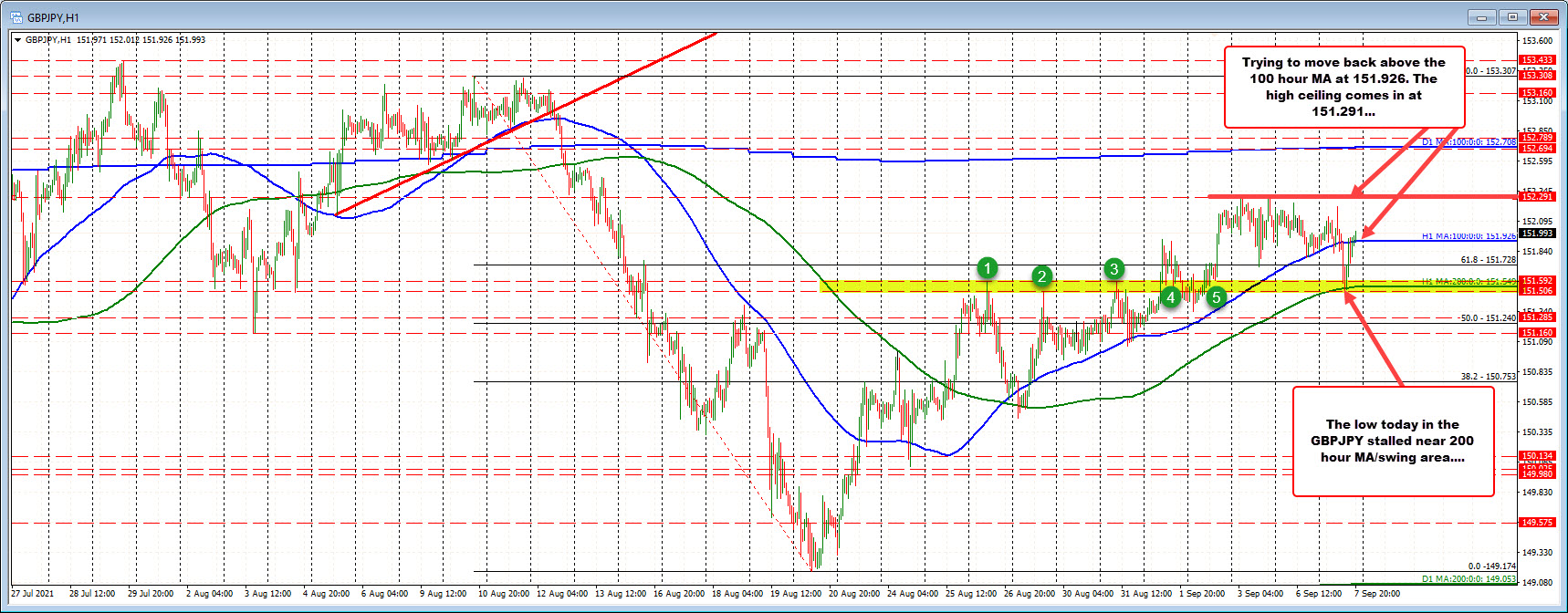

Swing area and rising 200 hour moving average helped to stall the fall today.

The GBPJPY was under pressure coming into the North American session today. The move lower took the price back down toward the rising 200 hour moving average (green line in the chart below currently at 151.549). A swing area between 151.506 and 151.592 was also tested.

The price low moved to 151.49, but could not sustain downside momentum. The price for the GBPJPY started to rebound, and last few hours has seen the price traded above and below the 100 hour MA (blue line). A new North American high was just reached at 152.01 – above the 100 hour MA at 151.926.

If the buyers are to take further control, staying above the 100 hour moving average will now be eyed. That is close risk for intraday longs.

On the topside, the Friday highs came in at 152.291 (not once but twice). The high yesterday at

152.245 and the earlier high today 152.213 will be the next targets ahead of the Friday high. Get above each and the buyers add to the control.