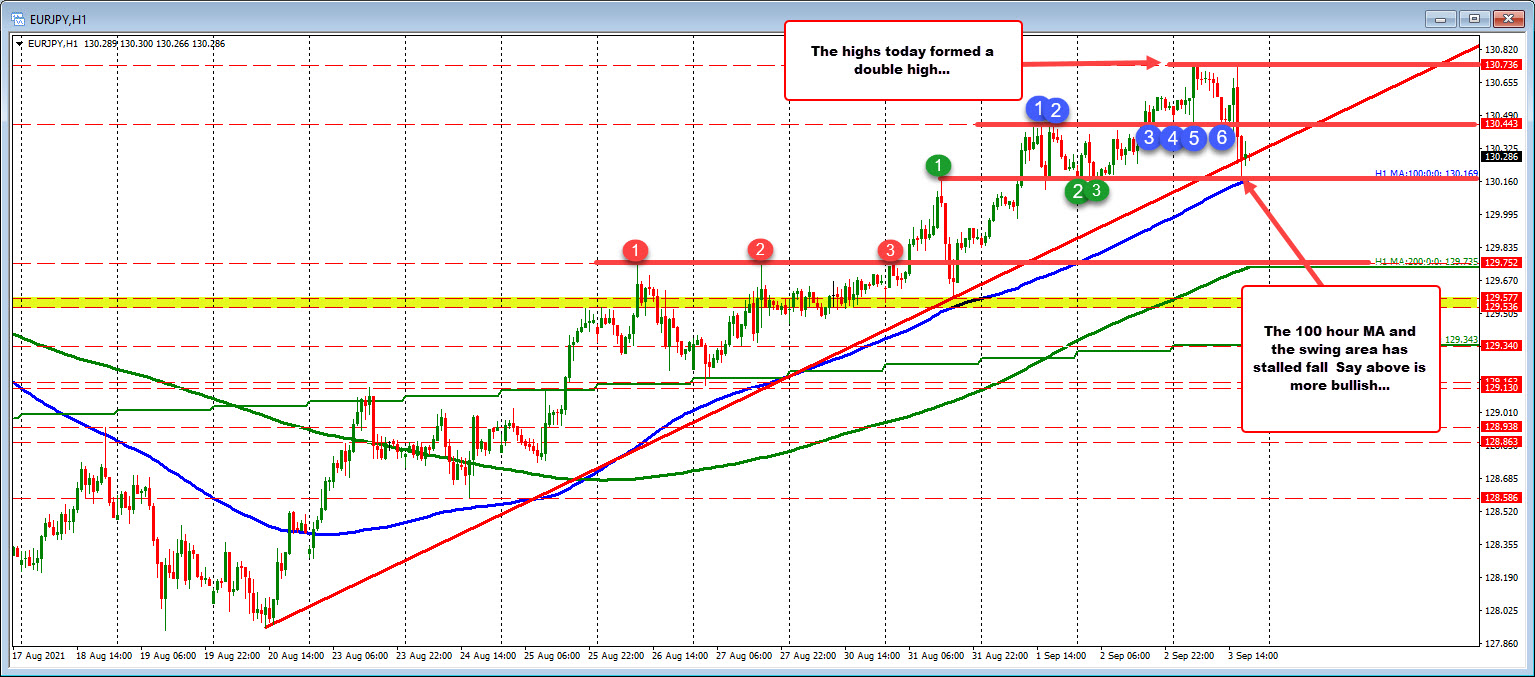

100 hour MA and swing level at 130.169

The EURJPY has been marching higher since bottoming on August 20. The price had been up for 9 of the last 10 trading days coming into today. The price is currently lower after a double top near 130.736.

The subsequent fall took the price below a swing area defined from highs on Wednesday, a few lows on Thursday and earlier lows today (see blue numbered circles). That level came in at 130.443.

The fall below that swing level took the price down to test its 100 hour moving average and another swing level at 130.169 (see green numbered circles).

The holding of the 100 hour moving average keeps the buyers more in control despite the down day today. the trend since August 20 is stepping higher.

However there is a battle between the buyers and sellers now with the double top at 130.736, the swing level at 130.44, and the 100 hour moving average/swing area at 130.169 as the risk/bias defining levels.

Stay above the 100 hour moving average keeps the buyers in control with a move above 130.44 as a another tilt more to the upside.

Conversely if the 100 hour moving average is broken, we should see further selling with focus on the 200 hour moving average at 129.735 as the next target. That level also was a ceiling on August 26, August 27, and August 31 (see red numbered circles).