AUDUSD lower on the day despite gains in stocks

The AUDUSD is not seeing a lot of “risk on” flow despite soaring Nasdaq and solid gains in the S&P as well. Both those indices are on pace for yet another record close. The S&P will be gunning for its 53rd record close in 2021. For the Nasdaq it is on pace for record close #32. Each of those indices are up seven of the last eight trading days as well.

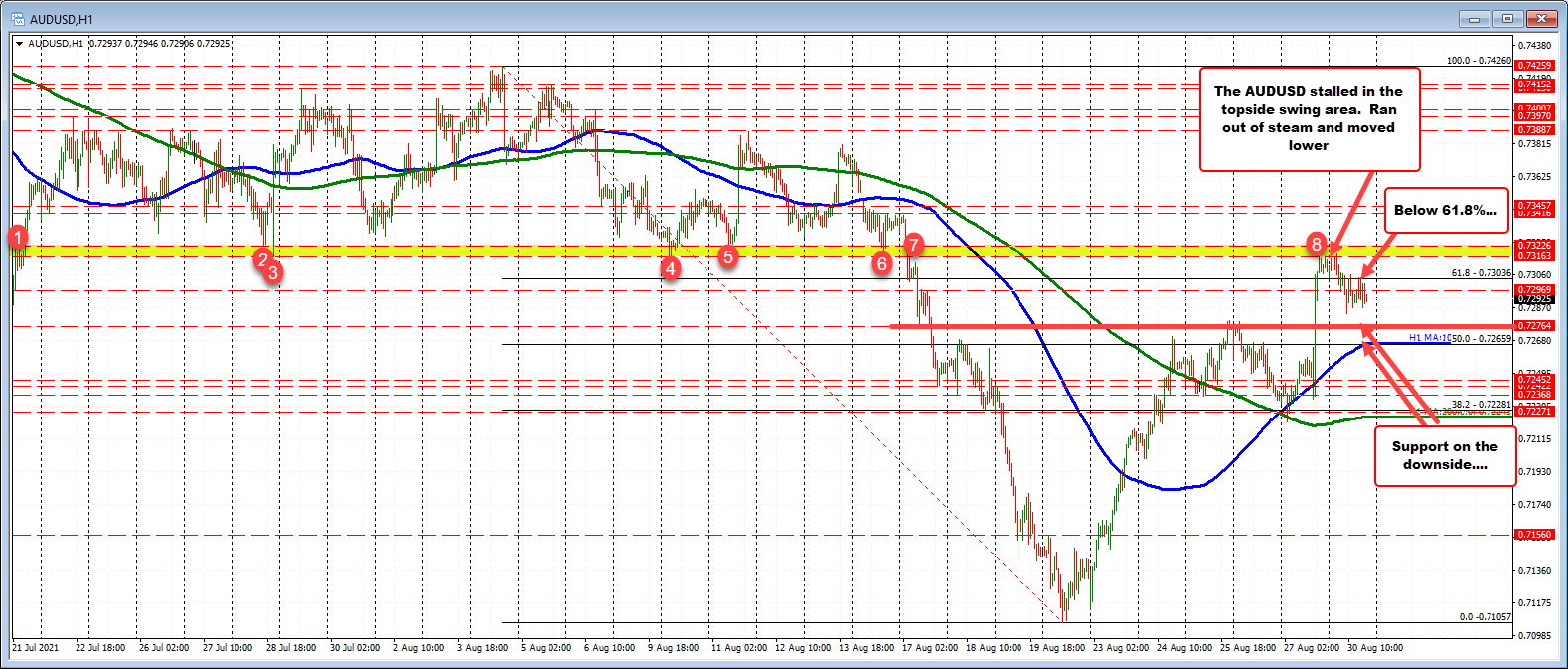

Looking at the hourly chart, the pair moved sharply higher on Friday help by risk on flows and the lower dollar. Today, the price for the AUDUSD pair tried to move higher, but found willing sellers in the swing area between 0.7316 and 0.73226. The inability of the price to move higher, turn buyers and sellers, and there has been a modest drift to the downside.

The low to high trading range for the trading day is still only 34 pips. That is well below the 60 PIP average over the last 22 trading days.

Technically the price is back below the 61.8% retracement of the August trading range at 0.73036. If the pair is to go higher, getting above that technical level and the swing area up to 0.73226 are the upside hurdles.

What would ruin the bullish picture at least from the hourly perspective?.

Moving below 0.7276 would be a modest negative. A more substantial break (and disappointment) would be a move below its 100 hour moving average and 50% retracement. Both of those levels are converged currently at 0.72659.

Move below that level would ruin the bullish bias technically and likely lead to buyers turning back to sellers at least in the short term.