German Dax lower, France’s CAC higher

The major European indices are ending the session with modest gains

- German DAX, -0.3%

- France’s CAC, +0.2%

- UK’s FTSE 100, +0.3%

- Spain’s Ibex, +0.3%

- Italy’s FTSE MIB, unchanged

In other markets as European/London traders look to exit

- Spot gold is down $-15.68 or -0.87% at $1786.26

- Spot silver is down -$0.12 or -0.52% $23.68

- WTI crude oil futures are trading up about $0.10 or 0.13% at $67.70.

- Bitcoin is trading up $682 and $48,413

In the US stock market, the S&P index traded to a new all-time high. Both the S&P and NASDAQ index or on track for a record close today (although gains are limited). The Dow industrial average has erased earlier declines in trades near session highs.

- Dow industrial average is up 83.3 points or 0.24% at 35452. The index was down -78.63 points at its low.

- S&P index is up 9.76 points or 0.22% at 4495.96. That is near the high for the day at 4496.11

- The NASDAQ index is up 17.29 points or 0.12% 15037.28. The high for the day reached a new all-time intraday record at 15052.20.

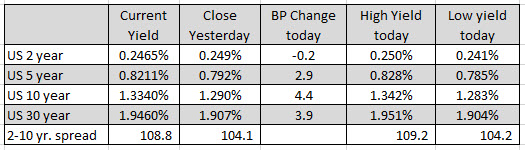

In the US debt market, yields have moved higher, with the 10 year moving up to 1.342% at its highs. The low today reached 1.283%:

A snapshot in the forex market now shows the NZD as the strongest of the majors, while the JPY is the weakest. The USD has been sold vs the EUR and GBP over the last few hours of trading and in the process worked back toward the highs for the day in what has been an up and down day for those pairs. The USD is stronger versus the JPY as that pair reacts to the higher yields.

The preliminary durable goods orders in the US came in near expectations give or take with the revisions. The weekly crude oil data showed modestly larger drawdowns of crude and gasoline inventories. The drawdowns were also greater than the private API data released near the close yesterday.

- Crude oil, -2979K versus -2683K expected

- Gasoline -2242K vs -1557K expected

- Distillates +645K vs -271K expected

- Cushing +70K vs -980K prior

The API data from late yesterday showed:

- Crude -1622K

- Distillates -245K

- Gasoline -985K

- Cushing -500K