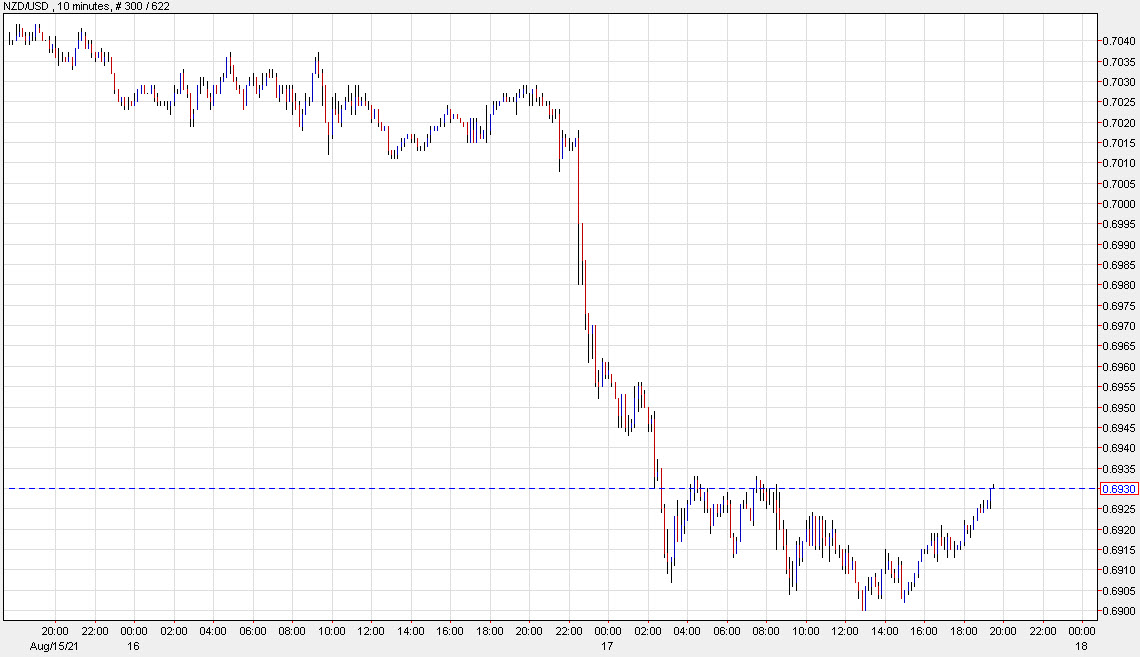

Modest bounce in the New Zealand dollar

Today’s NZD trade is a unique one.

The game-changing news of 5 covid cases in New Zealand came a day ahead of the decision and argues for a wait-and-see attitude. Hiking now only to see cases get out of control and a longer nationwide lockdown would look foolish.

On the other hand, the RBNZ is combating real inflationary pressures and if they don’t hike now, there’s no meeting scheduled until October 6 and they could fear that puts them behind the curve, especially since there’s a good chance that this outbreak is quashed and vaccinations make great progress by then.

As for the trade, do you want to buy NZD on a hike only to hear hours later that there are another 5 cases? Conversely, do you want to sell on a ‘no move’ decision only to wait and watch for the remainder of the week as no cases are announced?

Every path is a tough one and you’re at the mercy of the inevitable and unknowable headlines in either direction. For now, it seems as though some of the sellers of yesterday’s news are taking some money off the table, leading to a grind higher in NZD.

Alternatively, you can make the argument that a hike is still more likely than the 60% that’s priced in. The RBNZ can caveat a hike to 0.50% by saying that’s still an extremely low level and that they won’t hike further until there’s clarity on delta and vaccines.