What levels are in play for the EURUSD and the GBPUSD. Are the bottoms in place

The GBPUSD and the EURUSD both nearly reached some key downside targets.. For the EURUSD, the pair got within 4-5 pips of the 2021 low for the year and has bounced modestly.

For the GBPUSD the pair reached the 38.2% retracement of the move up from the July 20 low and it too has bounced modestly..

The questions for both is “Have they reached a low?” and “What would give the dip buyers some comfort now?”.

EURUSD: The EURUSD moved to a intraday low of 1.17088. That was just short of the low for the year from March 31 at 1.17035. A move below that level would also target the 38.2% of the move up from the March 2020 low to the January 2021 high.

Getting below those levels would increase the negative bias and I would argue for lower levels as a result.

Of course, there is the risk for the shorts/sellers that the low today was close enough and there is a bounce in the new day.

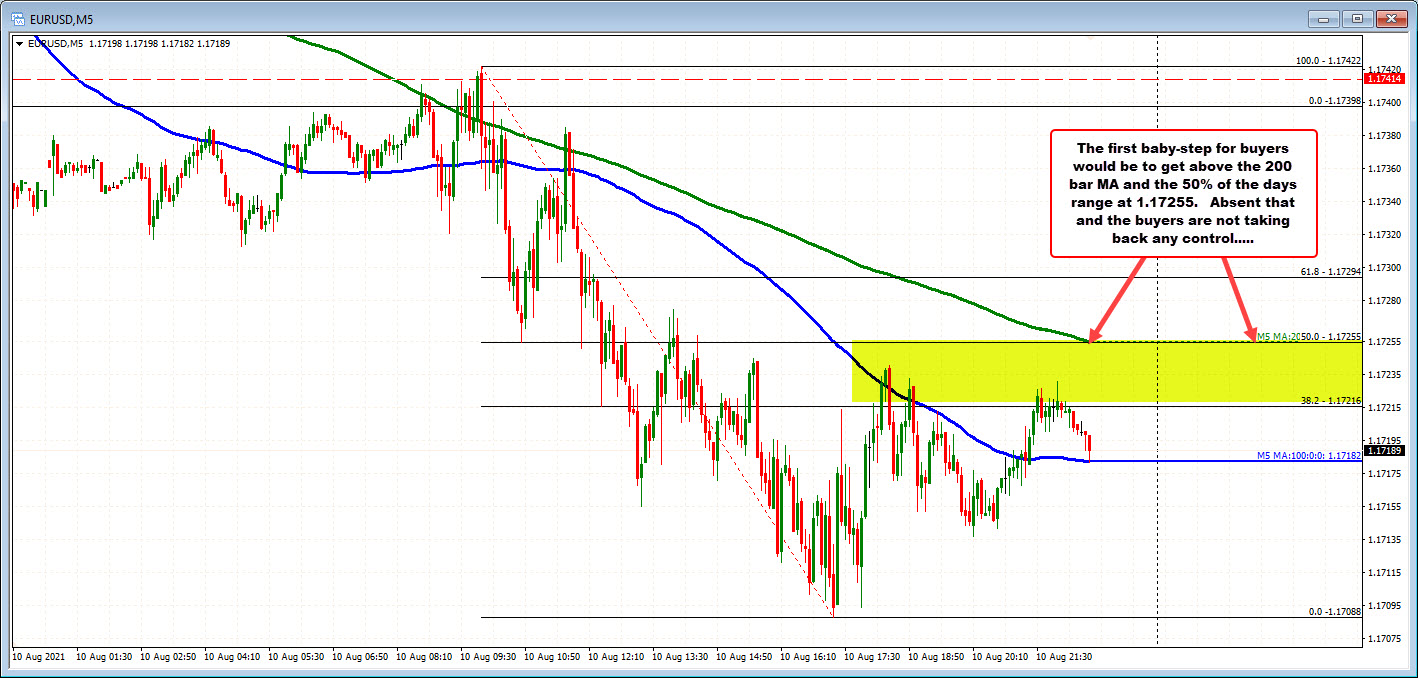

If so, traders will start to look for upside baby steps. The first would be to get above the 200 bar MA on the 5-minute chart and staying above (green line in the chart below). That is also near the 50% midpoint of the move down today at 1.17258. Get above both, is a step in the bullish direction. Absent that and the buyers ARE NOT taking back any control. The sellers have a better shot at going below the low for the year and the 38.2% retracement.

There is no doubt that traders leaned on the first test of the “plain Vanilla” retracement level.

That could lead to a rotation back higher as traders call the end to the selloff.

Looking at the 5 minute chart, the correction of the last move lower stalled at the 38.2%. The 100 bar MA is near that level and the 200 bar MA is at 1.3848 (green line in the chart below). Get above both and the calls might be for more upside probing as the sellers turn to buyers at least for now.