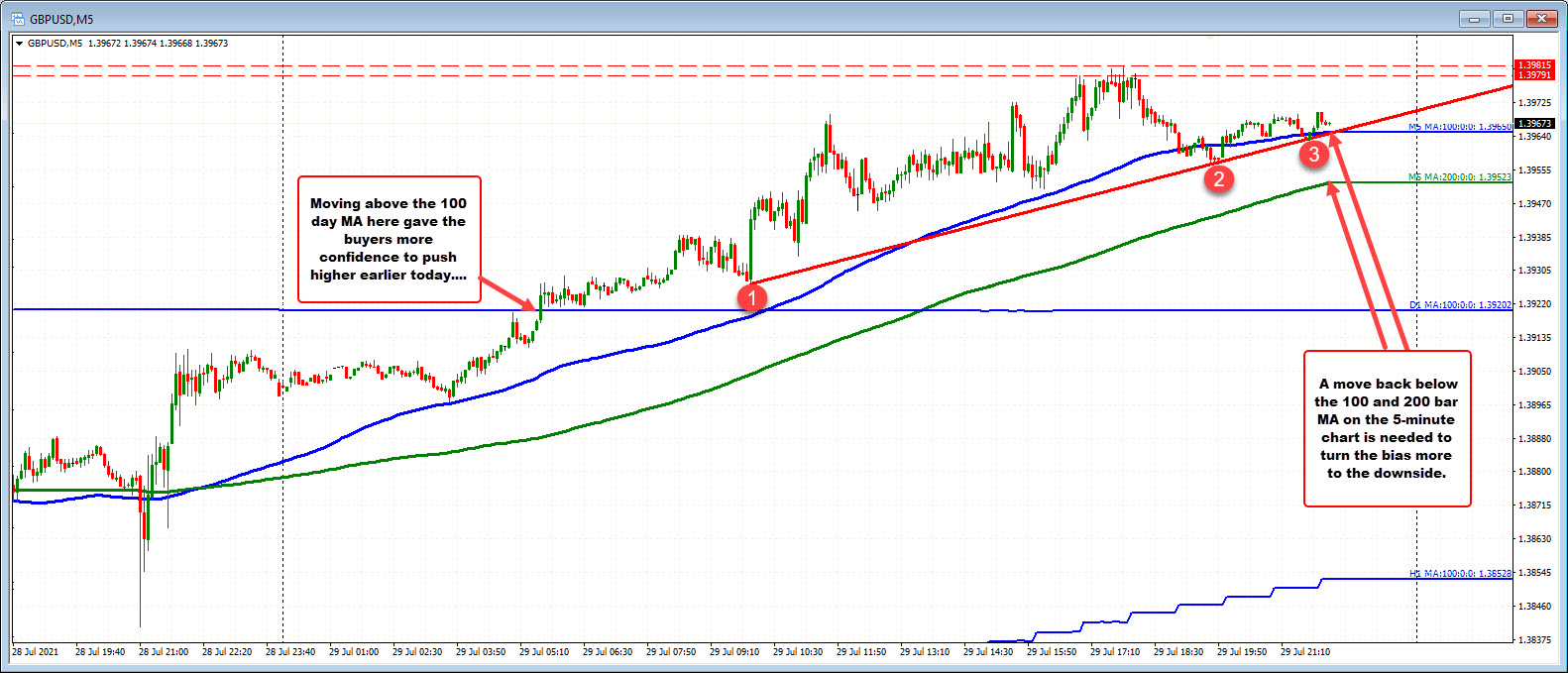

Price trades above and below the 100 bar MA on the 5-minute chart.

The GBPUSD has seen steady upside momentum today. The range is still a little low at 84 pips vs the 22-day average of 96 pips. So the price action is not racing higher, but more steady.

The price did move briefly below the 100 bar MA (blue line) an hour or so ago, but momentum stalled fairly quickly and certainly well ahead of the 200 bar MA (green line). In the short term, as long as the price stays above each, it is hard to say the buyers are not in control.

Looking at the daily chart below, the pair has overhead target resistance at a swing area between 1.4000 and 1.40167. The high price today reached 1.39813 so far. The number of buyers and sellers near the level would likely give traders cause for pause at least in the short term. However getting back above the 100 hour MA is giving the buyers some confidence (and control) for now.