Forex news for North America trade on July 28, 2021:

Markets:

- Gold up $7.75 to $1806

- US 10-year yields down 0.5 bps to 1.2393%

- WTI crude oil up 60-cents to $72.24

- S&P 500 up 2 points to 4400

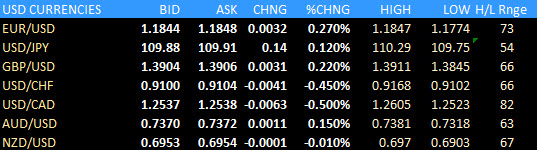

- CAD and CHF lead, JPY lags

On July 14, Powell said the FOMC was ‘still a ways off’ from the substantial further progress needed to taper QE. Today that shifted to still ‘some ground to cover’ in a tip-toe towards easing asset buys, namely in the labor market.

In addition, the statement said that progress had been made towards goals in a surprise shift. The initial reaction was USD buying and a rise in yields but that quickly turned around as the market decided that Powell wasn’t as hawkish as feared.

USD/JPY rose to 110.30 on the kneejerk and then fell back to 109.90. EUR/USD fell to 1.1770 before jumping to 1.1845.

Those are decent sized moves and were typical of the overall price action. I’m not entirely sure I fall in line with that — I would have expected a more dovish Powell — but that’s the price action for now.

Earlier, USD/CAD rose after Canadian inflation trailed estimates. The dip in y/y inflation to 3.1% from 3.6% highlights fading base effects as things like the gasoline pop fade.