Sluggish trading in EUR/USD continues

The US dollar was soft today across the board. Perhaps that’s Fed apprehension, perhaps that’s equity flows but it gave EUR/USD a lift.

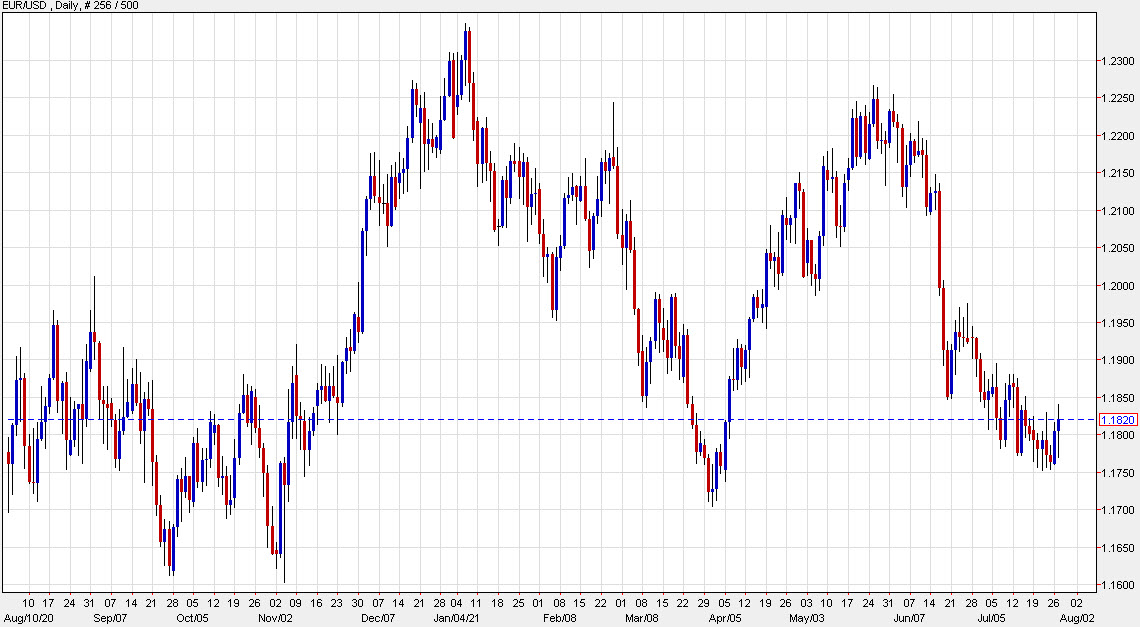

The pair has been locked in a 1.1750-1.1900 range for a month and now we’re back square in the middle at 1.1820 after touching a two-week high.

I’ve been writing about the constructive technical set-up in this pair for longs for a few days and it’s made some headway. There was the backing of support at 1.1750 and the March 31 low of 1.1704 along with a series of higher lows starting in November.

The problem with this pair is that you need some kind of catalyst. I like where Europe is headed with covid and vaccinations but I’m not sure that’s enough. In the longer term, there’s a good chance that US inflation eases by year end and there’s some downward pressure in 2023 so that’s another possibility. The thing is, there is going to be plenty of waiting around for that to happen and there’s some negative carry in EUR/USD longs.

This article was originally published by Forexlive.com. Read the original article here.