An optimistic twist

The official cash rate remained the same at 0.25%, but the headline surprise was that the RBNZ agreed to halt additional asset purchases under the LSAP agreement by July 23. This means that the RBNZ can be considered as setting up for a sooner rate hike than previously projected. The ANZ investment bank, for example, now see the RBNZ raising rates in August. The ASB bank had previously called for a November hike, but now too have brought that forward to an August hike.

Inflation

Like most central banks they expect inflation to rise and to be transitory:

The Committee reiterated that there will be near-term spikes in headline CPI inflation in the June and September quarters. These reflect factors that are either one-off in nature, such as high oil prices, or expected to be temporary in duration, such as supply shortfalls and higher transport costs.

The RBNZ showed some good sense in recognising that they were unsure how, or indeed if at all, the medium term outlook for inflation would be impacted. Halting the LSAP programme (although they had been reducing purchases significantly) shows that the RBNZ does not want to be guilty of over stimulating the economy.

Housing

The RBNZ need to assess the impact of their monetary policy on ‘affordable housing’. The low rates have been fuelling strong housing demand which have boosted prices. The RBNZ recognised that the recent rise in house prices has been unsustainable. Some Gov’t action had limited New Zealand house prices like the increase in loan to value restrictions and changes to housing tax policies. Also, extra supply in housing stock is expected to help keep a lid on prices. However, the key line from a monetary policy point of view is that, ‘the Committee agreed that any future increases in mortgage rates will further dampen house price growth’. This pretty much shows that the RBNZ are seeing rate hikes coming.

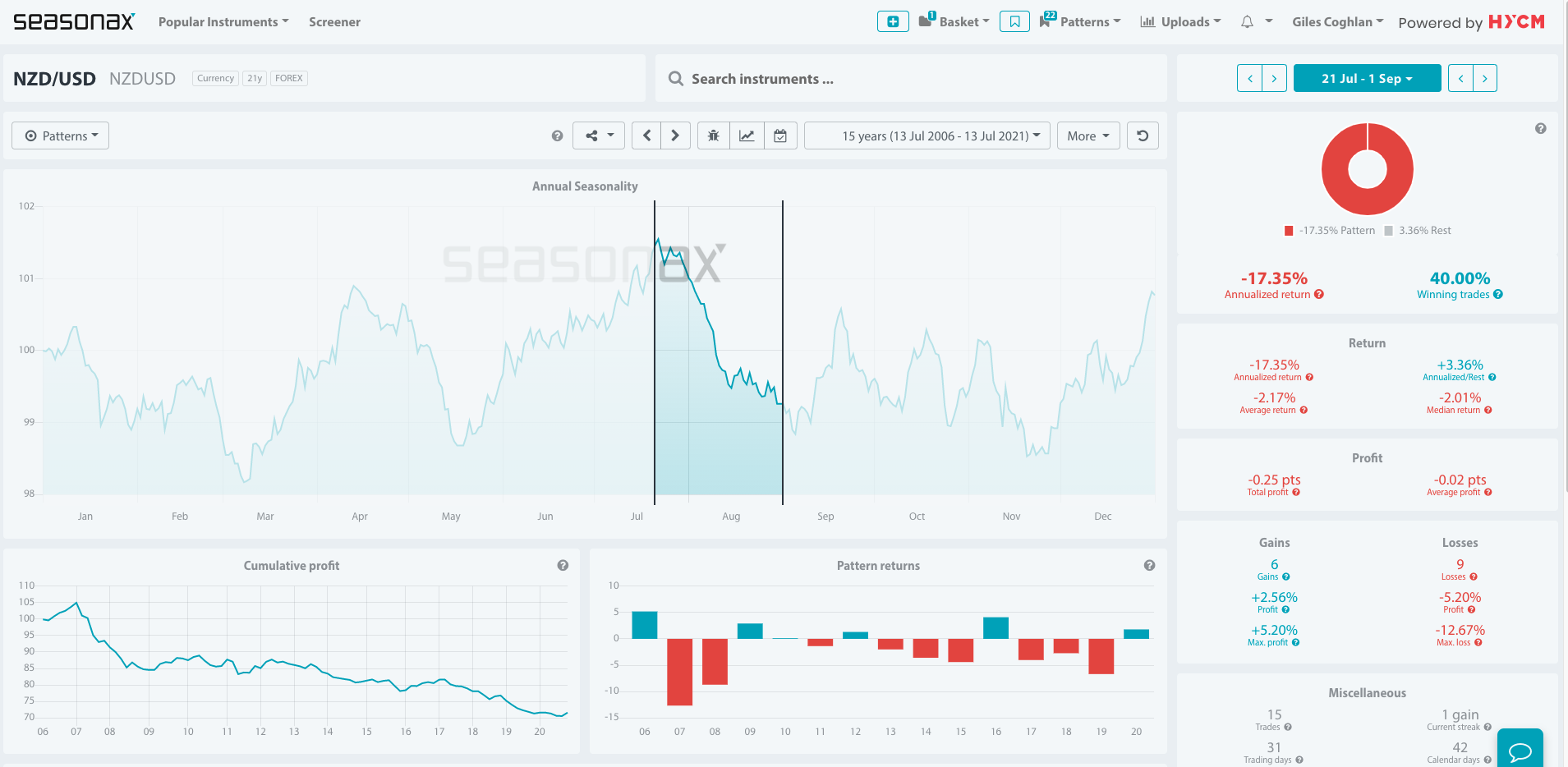

Seasonals

This opens up some medium term bullishness for the NZD. The NZDUSD currency pair does see a period of NZD weakness from a seasonal perspective as we come into August. The USD risk is also one we have to consider with the market uncertainty over what the Fed will do/won’t do and the impact that has on the USD.

The options

So, in terms of trading then AUDNZD shorts make sense and that should fall lower over the next few weeks with 1.0550 ‘ish looking like a good target. NZDJPY and NZDCHF longs also look good as long as the risk tone remains positive.